A Tax Savings Solution Using a Corporate Health Plan

The small business corporate tax rates can be quite a bit lower than an individual's income tax rates, especially as you take more money out of your company. So you can usually save taxes by using of corporate dollars whenever possible. Here's one great idea using your corporation to save on taxes - while also reducing the risk of health issues affecting the sustainability of your company.

Beyond Tax-Savings: The Benefits of an Estate Bond for your Estate Beneficiaries

This financial planning strategy replaces your taxable investments with tax-free insurance benefits to your heirs, by-passing your estate and probate fees and keeps this portion of your legacy gifts private.

Understanding your life insurance options

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs. This document can help you understand the different types of insurance options and how to select the type of plan that best suits your needs for coverage.

What are your risks of paying higher taxes in an emergency?

Your most valuable asset is your ability to earn income. What are the chances of you being unable to work due to accident or illness? What about the risk of paying higher taxes if you're relying on withdrawing RRSPs for additional monies required - to pay for extra medical and non-medical expenses? What about if you have to get extra help or your family has to reduce work hours to help you out?

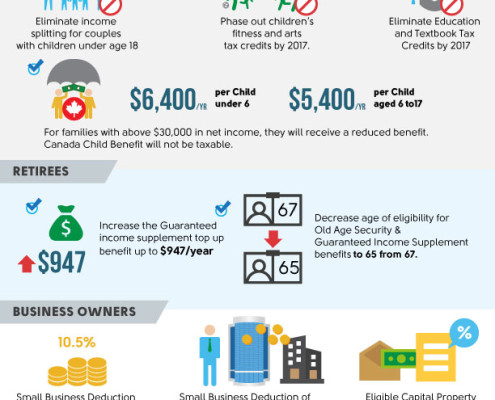

Federal Budget 2016

The Honourable Bill Morneau, Minister of Finance, recently…

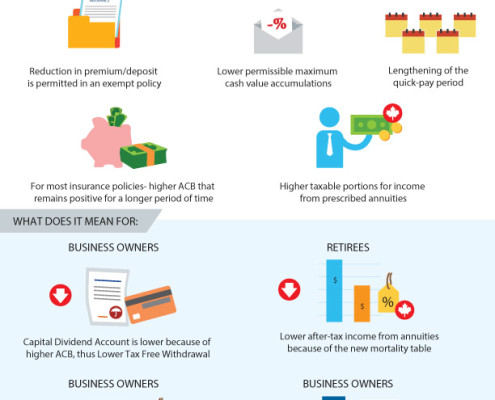

Tax-Exempt Legislation Changes

The tax-exempt changes to life insurance become effective Jan 2017. Having the appropriate plans in place can therefore be significantly more beneficial to you if ISSUED in 2016, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.

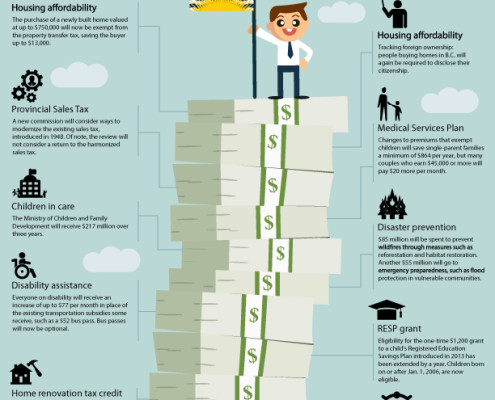

BC Budget Changes

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

Estate Planning for Real Estate Investors

For many Canadians the majority of their wealth is held in personally owned real estate. For most this will be limited to their principal residence, however, investment in recreational and real estate investment property also forms a substantial part of some estates. Due to the nature of real estate, it is important to utilize estate planning to realize optimum gain and minimize tax implications.

Leave a Financial Legacy for your family and less taxes for the government

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.