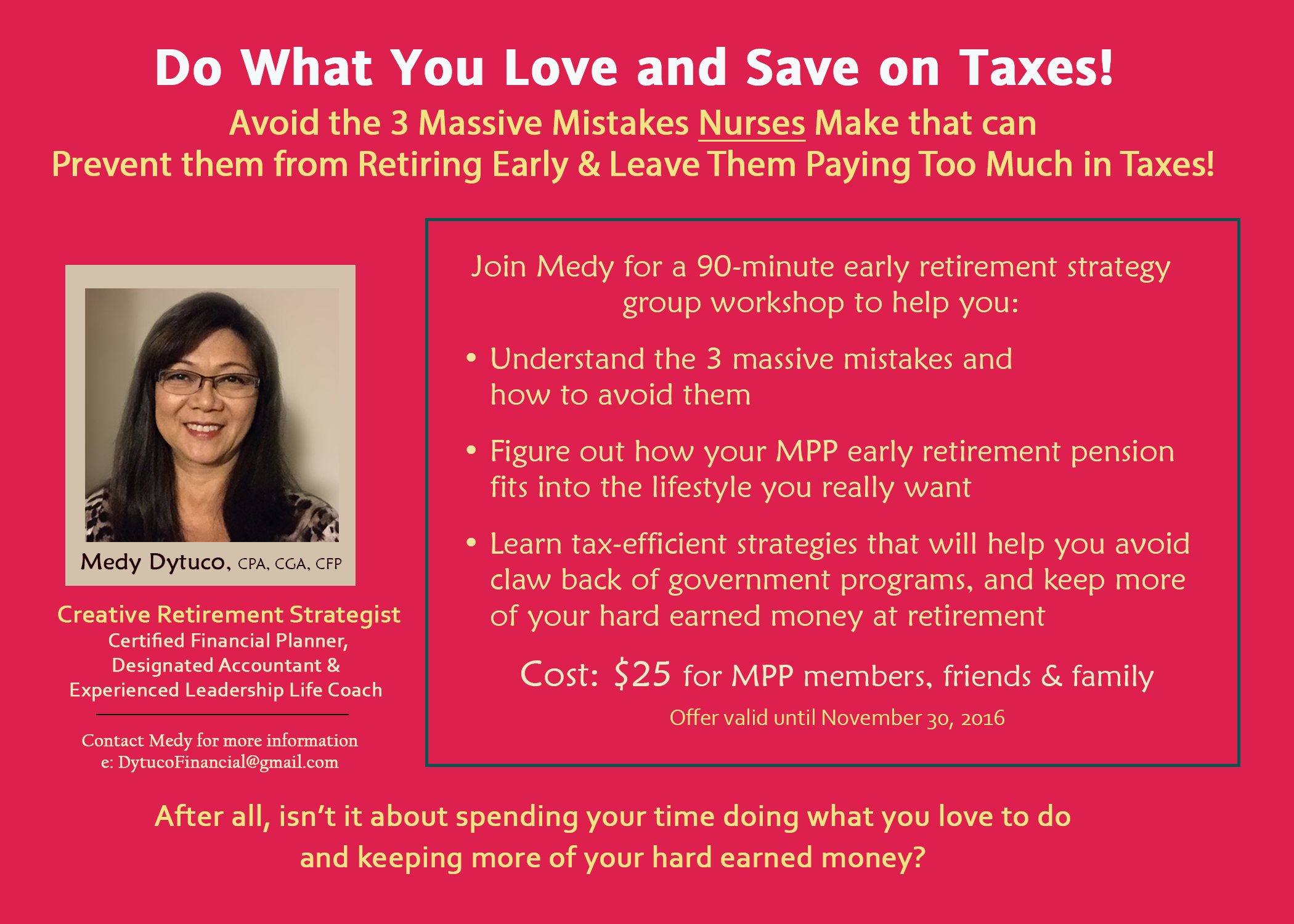

Why the focus on Nurses? Primarily because from what I’ve seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket – so a lot of that extra money you’ve earned just goes to paying extra taxes.

So how do you retire early when you know you’ll be getting a reduced pension?

The answer is really in your take-home pay, after taxes. So learning different strategies to reduce your taxes is key. This includes different financial and business solutions as it’s even better when you’re able to do what you love to do for less.

Let me know if you are interested in organizing a workshop for your own group of friends, family or co-workers and I can make that available at a lower price for groups of 6 or more people.

The group workshops can also be combined with a personal confidential consultation that looks at your specific individual pension income, needs & estimated expenses at retirement to generate a specific plan customized for you.

OTHER WORKSHOPS AVAILABLE

-

Individual Early Retirement Workshop Session

-

Explore business ideas (doing what you love) to supplement your retirement income

-

Creative Retirement Planning for Professional Women

Click here for a information on the individual workshop session: pdf-post-nurses-and-mpp-members-offer-extended-to-15dec2016

or a printer-friendly copy of the group workshop information: pdf-post-group-workshop-nurses-and-mpp-members-offer-extended-to-15dec2016

For more information on this topic and other areas of financial planning, see the library of articles found in: www.DytucoFinancialServices.com. Also watch out for other current and upcoming posts on:

- Tips on teaching your children about money

- Thinking beyond the typical “estate planning box”

- Business planning and how to avoid the top 3 mistakes made by start-up entrepreneurs

Please share this with a friend, family member or co-worker who might get value out of this information. Also feel free to contact me for a complimentary review of your financial plan. I can help you look at different & creative strategies to meet your specific needs for covering your risks, reaching your financial goals, and saving for your family & your retirement.