Financial Planning for You & Your Family

Click below to view our video about protecting your family

Video created by Jaime Munro from Whisper Media (www.whispermedia.ca)

Video created by Jaime Munro from Whisper Media (www.whispermedia.ca)

So together, we’ll look at your specific financial goals, understand what’s important to you, and find some creative solutions that will help make it easier to reach those goals and get more out of your hard-earned money.

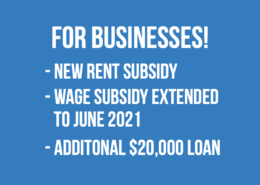

This may include a combination of cash & asset management solutions, tax planning, estate planning, risk management & insurance solutions, optimizing benefits through your small business, maximizing benefits from government programs and other solutions that may be appropriate to meet your specific needs.

So covering that risk is a very important part of a financial plan that will help you get through some of life’s unexpected challenges.

For major illness and inability to work you’ll need a plan to cover the following, and preferably in a tax-efficient way so you don’t lose more of your savings on paying higher taxes. Expenses can include:

In the case of premature death of one of the parents, you will need to: