Do You Need Individual Life Insurance?

In a recent study conducted by the Life Insurance and Market Research Association (LIMRA), it was reported that61% of Canadians hold some form of life insurance. Surprisingly, it also revealed that only 38% of Canadians own an individual life insurance contract.

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

What is Key Person Insurance?

Most business owners understand that assets vital to the success of the enterprise should be insured. Premises are routinely covered for fire and/or theft; vehicles used to make deliveries, insured; machinery needed for manufacturing, also insured. Given that these tangible assets are instrumental in the success of the business, it makes good business sense that the business is protected in the event of a loss. But what about key employees? Many business owners overlook the impact on their business should a key employee die unexpectedly.

A Group Workshop: Early Retirement Planning for Nurses & MPP (Pension Plan) Members

Learn some tax-efficient ways to supplement your early retirement pension while doing what you love.

Creative Retirement Planning – My Personal Example

Here's a personal example of my creative retirement plan that has me using what I love to do (travel) to support the life that I want to live - without taking on another JOB!

A Different Perspective on Teaching your Children to be Empowered about Money

Parents who believe that it’s important to teach children “about money” know that this is an important part of helping them be successful in life. Many however find it difficult because they think their children are too young and/or not interested, and they themselves are too busy with life in general. In reality, you are continually teaching them because they learn more from what you do than what you say.

Video: A Different Perspective on Early Retirement Planning for Nurses

A video for Nurses on the MPP (pension plan) who want to retire early. It provides a different perspective to make up the difference between the early retirement pension and full pension - through tax-efficient solutions that reduce taxes and help avoid claw backs of government credits!

Video: A Different Perspective on Retirement Planning for Professional Women

A video about a different perspective on retirement planning for professional women who've been too busy to plan for their retirement, or are just tired of the same old, same old financial advice.

Workshop: A Different Perspective on Early Retirement Planning for Nurses

Why the focus on Nurses? Primarily because from what I've seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket - so a lot of that extra money you've earned just goes to paying extra taxes. So how do you retire early when you know you'll be getting a reduced pension? By finding tax-efficient ways to cover that gap to reduce taxes and avoid claw backs of government pension!

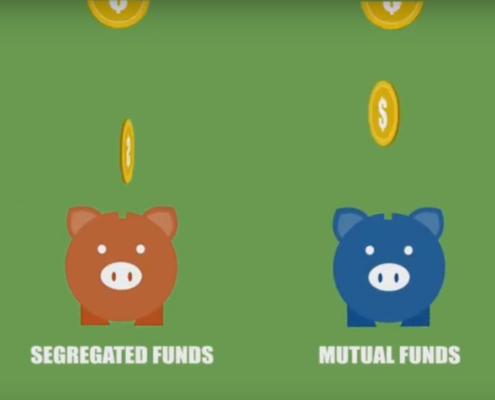

Segregated Funds or Mutual Funds

Segregated Funds or Mutual Funds? What's the difference?

We outline the difference between segregated and mutual funds in this video.