Having a financial plan provides a road map to your financial well-being.

Having your plan periodically reviewed & updated ensures it stays current to meet your evolving needs and is aligned with life’s changes.

Video created by Jaime Munro from Whisper Media (www.whispermedia.ca)

Needs vary as we go through different life stages. For example, needs and priorities may include:

Starters (age 21 to 34 – finishing school or starting on career path):

- to pay off student & other debts, establish an emergency fund, or to save for a major purchase such as a first home.

Builders (age 35 to 44 – may have kids and own a home):

- to provide for dependents, repay mortgage and debts, save for children’s education, ensure families are financially provided for in event of death or disability.

Accumulators (age 45 to 54 – may be progressing in their career and/or have grown young adult children):

- to save for all stages of retirement, reduce current & future income tax, to avoid creating a burden to family in case of major illness.

Accelerators (age 55 to 64 – may be preparing for retirement):

- to re-align and ramp up retirement savings if required, reduce taxes & expenses as you move closer to retirement, ensure adequate provision for living and health care expenses of surviving spouse in the event of death of one spouse.

Preservers (age 65+ may be retired and still active):

- to live comfortably in retirement, minimize tax in transferring assets to the next generation, provide for final expenses and taxes, and simplify estate settlement for the family.

Our Process

Determining your goals and expectations

Clarifying your present situation and identifying any shortfalls, issues or opportunities

Reviewing & selecting options to cover your needs

Implementation

Monitoring your plan and making adjustments if necessary

Financial Planning Articles of Interest

2022 Financial Calendar

Looking for an "at a glance" document covering all the important dates you need to know to stay on track with your financial planning in 2022?

Our 2022 financial calendar (which you can easily bookmark or print out) makes sure you're always in the loop! It lists important dates, including:

• Payments dates for the Canada Child Benefit, CPP, OAS, and the GST/HST credit.

• When TFSA contribution room starts again.

• Tax filing deadlines.

• Charitable contribution deadlines and the last day to contribute to registered investment accounts.

• When the Bank of Canada interest rate announcements are.

Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

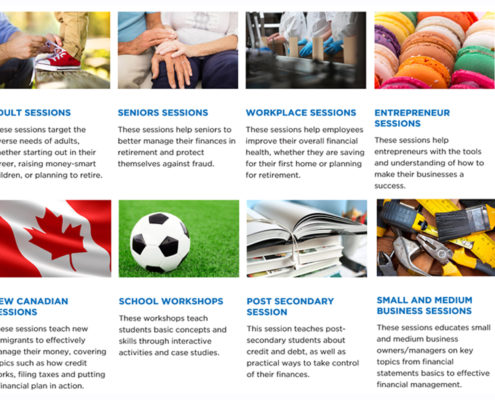

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

A Group Workshop: Early Retirement Planning for Nurses & MPP (Pension Plan) Members

Learn some tax-efficient ways to supplement your early retirement pension while doing what you love.

Creative Retirement Planning – My Personal Example

Here's a personal example of my creative retirement plan that has me using what I love to do (travel) to support the life that I want to live - without taking on another JOB!

A Different Perspective on Teaching your Children to be Empowered about Money

Parents who believe that it’s important to teach children “about money” know that this is an important part of helping them be successful in life. Many however find it difficult because they think their children are too young and/or not interested, and they themselves are too busy with life in general. In reality, you are continually teaching them because they learn more from what you do than what you say.

Video: A Different Perspective on Early Retirement Planning for Nurses

A video for Nurses on the MPP (pension plan) who want to retire early. It provides a different perspective to make up the difference between the early retirement pension and full pension - through tax-efficient solutions that reduce taxes and help avoid claw backs of government credits!

Video: A Different Perspective on Retirement Planning for Professional Women

A video about a different perspective on retirement planning for professional women who've been too busy to plan for their retirement, or are just tired of the same old, same old financial advice.

Workshop: A Different Perspective on Early Retirement Planning for Nurses

Why the focus on Nurses? Primarily because from what I've seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket - so a lot of that extra money you've earned just goes to paying extra taxes. So how do you retire early when you know you'll be getting a reduced pension? By finding tax-efficient ways to cover that gap to reduce taxes and avoid claw backs of government pension!

The Benefits of Converting Your Term Insurance to a Permanent Plan

Permanent life insurance can be a very effective estate planning & tax saving tool for your family and business. Converting an existing term insurance to permanent is an easy way to get that permanent coverage - and with the tax rules changing Jan 2017, you get a lot more tax-free benefits if you convert this year.

Creative Retirement Planning Workshop for Professional Women

Tired of every other financial advisor just moving your money from one investment to another and telling you to stop buying your favorite coffee? When you work with me, we'll first look at your vision of your ideal life at retirement, then explore different financial solutions to help you use doing what you love to save on taxes so you can keep more of your hard-earned money!

Interesting links

Here are some interesting links for you! Enjoy your stay :)Pages

Categories

- 2020

- 2020 Only

- 2021

- 2022

- Accountants

- Articles

- Blog

- Budget

- Business Owners

- Children

- Coronavirus

- Coronavirus – Associates

- Coronavirus – Practice Owners

- Coronavirus – Retired

- Coronavirus – Retiring

- Coronavirus – Students

- corporate

- Critical Illness Insurance

- Debt

- disability

- Disability Insurance

- Employees

- Estate Planning

- Families

- Family

- financial advice

- Financial Planning

- health benefits

- incorporated professionals

- Individuals

- Investment

- Key person

- Life Insurance

- mortgage

- Mortgage Insurance

- News

- personal finances

- Professional Corporations

- Professionals

- RDSP

- retirees

- Retirement

- Retirement Planning

- Risk Management

- RRSP

- Savings

- Tax

- Tax Free Savings Account

- Tax Savings

- Term Insurance

- Videos

- Wealth Protection

- Women

- Workshops

Archive

- January 2022

- April 2021

- February 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- March 2018

- February 2018

- January 2018

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015