Comparing TFSAs and RRSPs – 2020

We examine the difference between RRSP and TFSA in the deposit and withdrawal stage.

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

2020 Financial Facts for Employees

2020 Financial Facts for Employees includes Consumer Price Index, Bank of Canada Interest Rate, Federal Income Tax Brackets, TFSA, RRSP, CPP, OAS, Probate Fees, Canada Child Benefit, Registered Disability Savings Plan and RESP Numbers.

2020 Financial Facts for Business Owners

2020 Financial Facts for Business Owners include Interest Rate, Corporate Tax Rates, Employment Insurance Premium Rates, CPP Contribution Rates, Corporate Investment, Income Tax Rate, Limits

Insurance- Types that are needed, Lifetime Capital Gains Exemptions

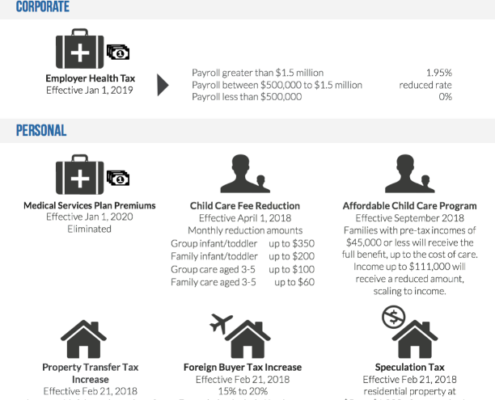

2018 Federal Budget Highlights for Families

Several key changes relating to personal financial arrangements are covered in the Canadian government’s 2018 federal budget, which could affect the finances of you and your family.

2018 Federal Budget Highlights for Business

The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC). (Previously proposed in July 2017.)

BC Budget Highlights 2018

BC Finance Minister Carole James delivered the province's 2018 budget update on February 20, 2018. The budget anticipates a surplus of $219 million for the current year, $281 million for 2019 and $284 million in 2020.

RRSP Deadline is March 1, 2018. How much tax can you save?

The deadline for contributing to your Registered Retirement Savings Plan (RRSP) for the 2017 tax filing year is March 1, 2018. You generally have 60 days within the new calendar year to make RRSP contributions that can be applied to lowering your taxes for the previous year.

Investing with a Safety Net

Investing in today’s environment is not for the faint of heart. However, fortunately for Canadians, Segregated Fund products offered by many life insurance companies provide a safety net for nervous investors.

A New Year’s Resolution You Shouldn’t Break

Many of us set New Year’s resolutions for ourselves and often those resolutions have to do with finances. January is the month we say, “Ok, this year I am going to save more and spend less”.