Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

CERB Extended | Business Owners who did not qualify previously – expanded CEBA starts June 19th

Great news for Canadians out of work and looking for work. The CERB will be extended another 8 weeks for a total of up to 24 weeks.

The expanded CEBA will begin June 19th.

Comparing TFSAs and RRSPs – 2020

We examine the difference between RRSP and TFSA in the deposit and withdrawal stage.

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

2020 Financial Facts for Employees

2020 Financial Facts for Employees includes Consumer Price Index, Bank of Canada Interest Rate, Federal Income Tax Brackets, TFSA, RRSP, CPP, OAS, Probate Fees, Canada Child Benefit, Registered Disability Savings Plan and RESP Numbers.

2020 Financial Facts for Business Owners

2020 Financial Facts for Business Owners include Interest Rate, Corporate Tax Rates, Employment Insurance Premium Rates, CPP Contribution Rates, Corporate Investment, Income Tax Rate, Limits

Insurance- Types that are needed, Lifetime Capital Gains Exemptions

2018 Federal Budget Highlights for Families

Several key changes relating to personal financial arrangements are covered in the Canadian government’s 2018 federal budget, which could affect the finances of you and your family.

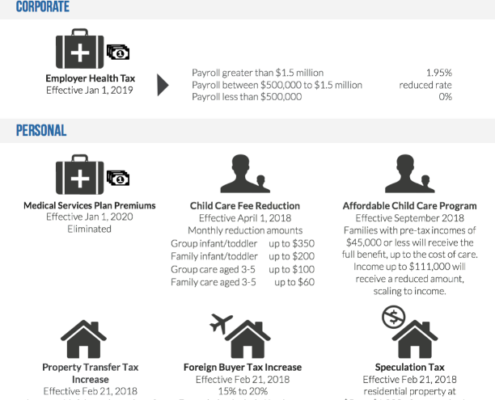

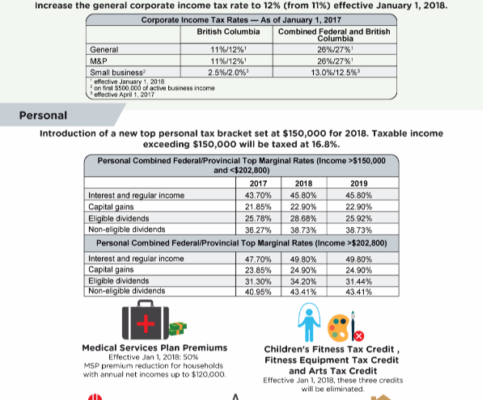

BC Budget Highlights 2018

BC Finance Minister Carole James delivered the province's 2018 budget update on February 20, 2018. The budget anticipates a surplus of $219 million for the current year, $281 million for 2019 and $284 million in 2020.

RRSP Deadline is March 1, 2018. How much tax can you save?

The deadline for contributing to your Registered Retirement Savings Plan (RRSP) for the 2017 tax filing year is March 1, 2018. You generally have 60 days within the new calendar year to make RRSP contributions that can be applied to lowering your taxes for the previous year.

BC Budget Update

BC Finance Minister Carole James delivered the province's 2017 budget update on Sept. 11, 2017. The budget anticipates a surplus of $46 million for the current year, $228 million in 2018-2019 and $257 million in 2019-2020. As a result of the provincial election on April 11, 2017, the measures previously announced were not fully enacted.