What are your risks of paying higher taxes in an emergency?

Your most valuable asset is your ability to earn income. What are the chances of you being unable to work due to accident or illness? What about the risk of paying higher taxes if you're relying on withdrawing RRSPs for additional monies required - to pay for extra medical and non-medical expenses? What about if you have to get extra help or your family has to reduce work hours to help you out?

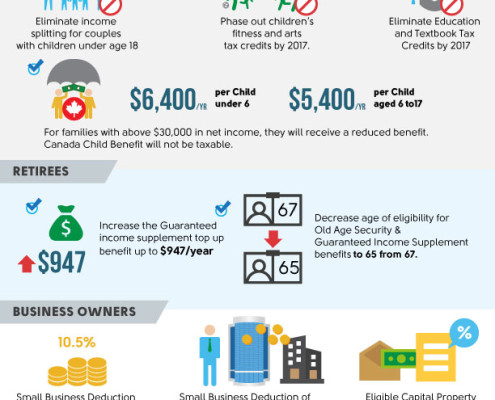

Federal Budget 2016

The Honourable Bill Morneau, Minister of Finance, recently…

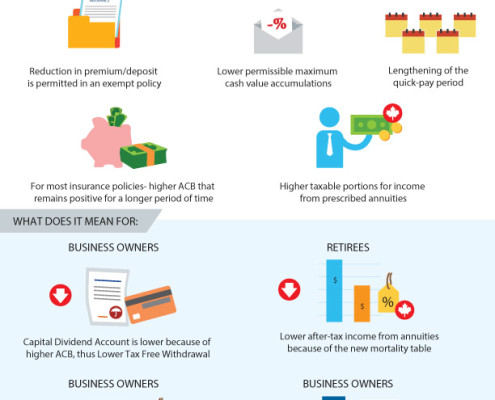

Tax-Exempt Legislation Changes

The tax-exempt changes to life insurance become effective Jan 2017. Having the appropriate plans in place can therefore be significantly more beneficial to you if ISSUED in 2016, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.