Retirement – Are you Prepared?

Whether you are decades away from retirement or if it is just around the corner, being aware of the planning opportunities will take the fear and uncertainty out of this major life event.

Investing with a Safety Net

Investing in today’s environment is not for the faint of heart. However, fortunately for Canadians, Segregated Fund products offered by many life insurance companies provide a safety net for nervous investors.

A New Year’s Resolution You Shouldn’t Break

Many of us set New Year’s resolutions for ourselves and often those resolutions have to do with finances. January is the month we say, “Ok, this year I am going to save more and spend less”.

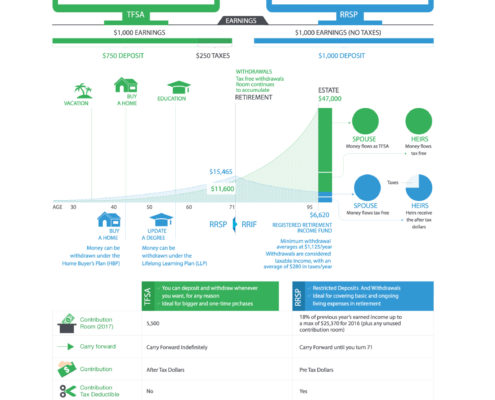

TFSA or RRSP: What’s the difference?

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest.

A Group Workshop: Early Retirement Planning for Nurses & MPP (Pension Plan) Members

Learn some tax-efficient ways to supplement your early retirement pension while doing what you love.

Video: A Different Perspective on Early Retirement Planning for Nurses

A video for Nurses on the MPP (pension plan) who want to retire early. It provides a different perspective to make up the difference between the early retirement pension and full pension - through tax-efficient solutions that reduce taxes and help avoid claw backs of government credits!

Video: A Different Perspective on Retirement Planning for Professional Women

A video about a different perspective on retirement planning for professional women who've been too busy to plan for their retirement, or are just tired of the same old, same old financial advice.

Workshop: A Different Perspective on Early Retirement Planning for Nurses

Why the focus on Nurses? Primarily because from what I've seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket - so a lot of that extra money you've earned just goes to paying extra taxes. So how do you retire early when you know you'll be getting a reduced pension? By finding tax-efficient ways to cover that gap to reduce taxes and avoid claw backs of government pension!

Segregated Funds or Mutual Funds

Segregated Funds or Mutual Funds? What's the difference?

We outline the difference between segregated and mutual funds in this video.

How to select Mortgage Insurance that gives you more benefits

See how getting your own coverage gives you & your family more benefits compared to getting Mortgage Insurance from your lender.