Having a financial plan provides a road map to your financial well-being.

Having your plan periodically reviewed & updated ensures it stays current to meet your evolving needs and is aligned with life’s changes.

Video created by Jaime Munro from Whisper Media (www.whispermedia.ca)

Needs vary as we go through different life stages. For example, needs and priorities may include:

Starters (age 21 to 34 – finishing school or starting on career path):

- to pay off student & other debts, establish an emergency fund, or to save for a major purchase such as a first home.

Builders (age 35 to 44 – may have kids and own a home):

- to provide for dependents, repay mortgage and debts, save for children’s education, ensure families are financially provided for in event of death or disability.

Accumulators (age 45 to 54 – may be progressing in their career and/or have grown young adult children):

- to save for all stages of retirement, reduce current & future income tax, to avoid creating a burden to family in case of major illness.

Accelerators (age 55 to 64 – may be preparing for retirement):

- to re-align and ramp up retirement savings if required, reduce taxes & expenses as you move closer to retirement, ensure adequate provision for living and health care expenses of surviving spouse in the event of death of one spouse.

Preservers (age 65+ may be retired and still active):

- to live comfortably in retirement, minimize tax in transferring assets to the next generation, provide for final expenses and taxes, and simplify estate settlement for the family.

Our Process

Determining your goals and expectations

Clarifying your present situation and identifying any shortfalls, issues or opportunities

Reviewing & selecting options to cover your needs

Implementation

Monitoring your plan and making adjustments if necessary

Financial Planning Articles of Interest

Canada Pension Plan – Should You Take it Early?

The new rules governing CPP were introduced in 2012 and they take full effect in 2016. The standard question regarding CPP remains the same - should I take it early or wait? We outline the reasons to take your CPP early or delay your CPP in this article.

Creative Risk Management Planning for your Business

Many would agree that two of the greatest risks to the sustainability of a business are: not having enough money to keep the company going in times of lower income, and losing the ability to make money. Here are some essential tax-savings & risk management strategies to keep your business going during medical emergencies, save you taxes and leave more money in your pocket.

Estate Planning for Blended Families

In today’s family it is not unusual for spouses to enter the marriage with children from previous relationships. Parents work hard at getting these children to functionally blend together to create a happy family environment. Often overlooked is what happens on the death of one of the parents. In most cases special consideration for estate planning is needed to avoid relationship loss and possibly legal action.

Your Life Could Change in a Minute!

Pay Attention to Your Beneficiary Designation

Naming a beneficiary is a valuable feature of life insurance and segregated funds policies so it is important to carefully choose your beneficiaries.

A Tax Savings Solution Using a Corporate Health Plan

The small business corporate tax rates can be quite a bit lower than an individual's income tax rates, especially as you take more money out of your company. So you can usually save taxes by using of corporate dollars whenever possible. Here's one great idea using your corporation to save on taxes - while also reducing the risk of health issues affecting the sustainability of your company.

Beyond Tax-Savings: The Benefits of an Estate Bond for your Estate Beneficiaries

This financial planning strategy replaces your taxable investments with tax-free insurance benefits to your heirs, by-passing your estate and probate fees and keeps this portion of your legacy gifts private.

Understanding your life insurance options

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs. This document can help you understand the different types of insurance options and how to select the type of plan that best suits your needs for coverage.

What are your risks of paying higher taxes in an emergency?

Your most valuable asset is your ability to earn income. What are the chances of you being unable to work due to accident or illness? What about the risk of paying higher taxes if you're relying on withdrawing RRSPs for additional monies required - to pay for extra medical and non-medical expenses? What about if you have to get extra help or your family has to reduce work hours to help you out?

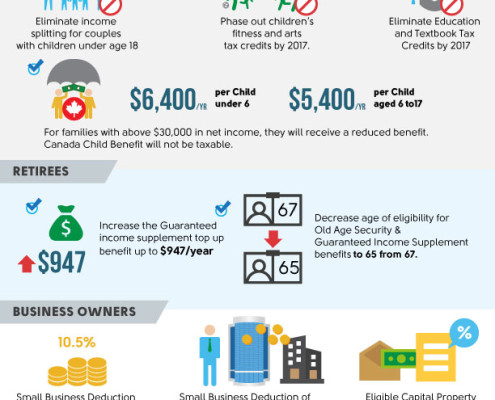

Federal Budget 2016

The Honourable Bill Morneau, Minister of Finance, recently…

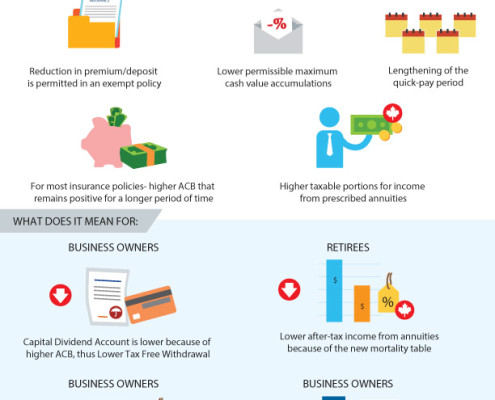

Tax-Exempt Legislation Changes

The tax-exempt changes to life insurance become effective Jan 2017. Having the appropriate plans in place can therefore be significantly more beneficial to you if ISSUED in 2016, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.

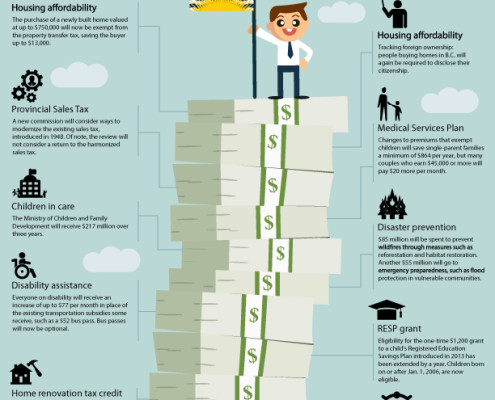

BC Budget Changes

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

Interesting links

Here are some interesting links for you! Enjoy your stay :)Pages

Categories

- 2020

- 2020 Only

- 2021

- 2022

- Accountants

- Articles

- Blog

- Budget

- Business Owners

- Children

- Coronavirus

- Coronavirus – Associates

- Coronavirus – Practice Owners

- Coronavirus – Retired

- Coronavirus – Retiring

- Coronavirus – Students

- corporate

- Critical Illness Insurance

- Debt

- disability

- Disability Insurance

- Employees

- Estate Planning

- Families

- Family

- financial advice

- Financial Planning

- health benefits

- incorporated professionals

- Individuals

- Investment

- Key person

- Life Insurance

- mortgage

- Mortgage Insurance

- News

- personal finances

- Professional Corporations

- Professionals

- RDSP

- retirees

- Retirement

- Retirement Planning

- Risk Management

- RRSP

- Savings

- Tax

- Tax Free Savings Account

- Tax Savings

- Term Insurance

- Videos

- Wealth Protection

- Women

- Workshops

Archive

- January 2022

- April 2021

- February 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- March 2018

- February 2018

- January 2018

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015