4 Simple Steps that Can Help You Catch Up & Grow Your Retirement Savings

(Article originally posted on Linked In by Medy Dytuco.)

Someone’s sitting in the shade today because someone planted a tree a long time ago

~ Warren Buffett (American business magnate, investor and philanthropist)

You’ve probably heard that many Canadians are not financially ready to retire, and many older Canadians are still dealing with high levels of debt (see key findings below from recent studies and links to other articles).

I’m sure you’ve also heard that it makes a big difference when you start saving earlier rather than later to avoid having to struggle at a later age. But how many young people do you know who actually make this a priority?

How many older people do you know still spend so much on discretionary expenses that they could be putting towards protecting their quality of life at retirement?

We all know that anything could happen in a blink of an eye, yet many of us act like it can only happen to other people. But as I was recently reminded, it can take only a few seconds to get an injury or illness that could devastate our quality of life*.

* see article on “a few seconds that can change your life” (https://dytucofinancialservices.com/blog-grid/)

SO WHERE DO YOU STAND?

Are you one of those people who actually review your financial/retirement plan every year or do you put it off year after year like many people?

If you’re not sure where you stand and you’d like to play around with the numbers yourself, here are links to some retirement fund calculators you can use. Just make sure you do a separate calculation for expenses related to major illness or long term care (which is usually left out of most software calculations).

https://ia.ca/retirement-calculator#

.

NOT ALL RETIREMENT YEARS ARE CREATED EQUAL

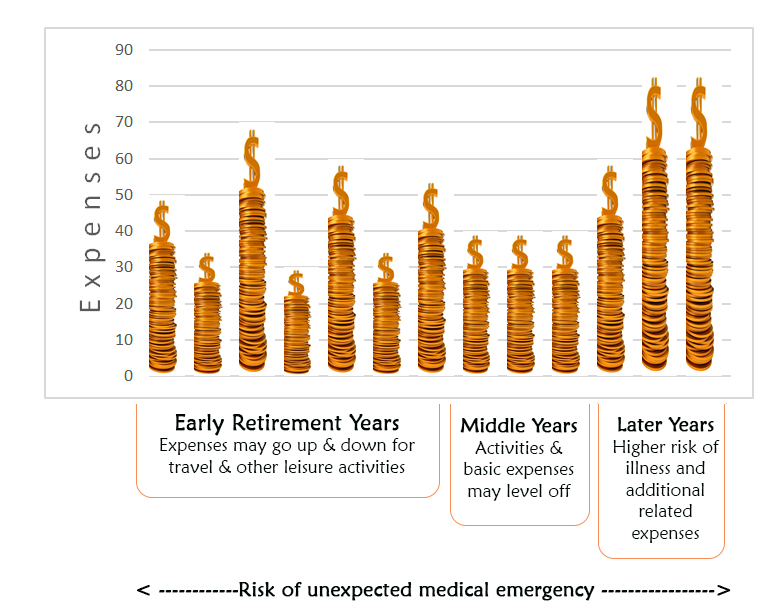

These retirement savings calculators should give you an idea of where you stand using an average amount for living expenses, HOWEVER, keep in mind that retirement income needs WILL vary through different stages (e.g. the beginning, middle and later stages).

For example, when you first retire you may be more active and travelling, during the “middle years” your activities and expenses may level out, then later the risk of illness increases as we age which may result in higher expenses for medical or long term care expenses (unexpected illness of course can also occur during the other 2 stages).

Most retirement plan calculators don’t allow for these different stages, so it’s best to have a customized needs analysis of your specific situation – to meet your specific retirement needs, & your desired lifestyle (see my video on retirement planning https://dytucofinancialservices.com/financial-planning-2/).

THE 4 SIMPLE STEPS TO HELP GROW YOUR SAVINGS

- Assess where you’re really spending your money. Look at your spending history over the last few months or years and be honest with yourself. Then continue monitoring your actual spending against your budget or “intended” spending.

- Minimize waste & manage your risks. (See my article on some common but sometimes hidden ways we waste money: 10 often overlooked places to look for savings https://dytucofinancialservices.com/blog-grid/); and cover your short-term and long-term risks to avoid having an unexpected event or illness derail your retirement plan (see findings from the OSC study mentioned below).

- Redirect some of your discretionary spending towards retirement savings. You may have to forgo on some “nice-to-haves” to put more towards your retirement savings and go through some “short-term pain for long-term gain”. Put another way, you may want to spend more of your money investing in building your dream retirement, rather than buying stuff you don’t really need, can put off until later, or indulging in retail therapy. Also look at some strategies that may help make it easier to save (e.g. using auto deposits into an account that’s not too easy to withdraw from) and harder to spend impulsively (e.g. like using cash for your spending money instead of your credit card).

- Look at other sources. See my article on “other ways” to earn extra money (https://dytucofinancialservices.com/blog-grid/). It’s also a good idea to use insurance-based solutions to supplement your retirement plan because most plans pay tax-free benefits. In some situations, getting a loan could also be a good way to catch up and take advantage of the RRSP tax deferral. If you’re not sure if it’s worth getting a loan, here’s a link to a calculator you can use to see if it’s beneficial for your specific situation. http://www.dynamic.ca/eng/learning/Calculator-RRSP-Loan.advisor.html

TFSA vs. RRSP?

Check out the differences (https://dytucofinancialservices.com/tfsa-or-rrsp/)

SAVING TO BUY YOUR FIRST HOME?

Keep in mind that your RRSP contributions are available for the Home Buyers’ Plan (HBP) program – which allows you to take up to $25,000 in a calendar year from your registered retirement savings plans (RRSPs) to buy or build a qualifying home for yourself. This money is taken out tax-free and is essentially “borrowed” from your RRSP account and you “repay” it yearly by contributing back to your RRSP (up to 15 years to pay). (http://www.cra-arc.gc.ca/hbp/)

REPORT FINDINGS & ARTICLE LINKS

Key findings of a 2015 national study by the OSC (Ontario Securities Commission) on the Financial Life Stages of Older Canadians include:

- Unexpected events that affected finances and retirement plans – such as a need to support adult family members, health issues, stock market decline, or loss of income – impacted 6 out of 10 older Canadians.

- Among retired persons under age 75, 35% reported that they were forced to retire earlier than they wanted. For two-thirds of this group, health reasons led to early retirement.

- Of those older Canadians who still intend to retire, 32% do not currently have a plan in place.

A 2014 study by the Conference Board of Canada showed:

- 60 % of survey respondents have not saved enough for retirement.

- Over one-third of Canadians say they don’t know when they’ll be able to retire.

- Over 40 % of employers believe their employees are overly optimistic in their assessment of when they will be able to retire.

- 60 % of current retirees say their retirement incomes are sufficient to meet their retirement needs, but many project difficulties over time.

Here also are links to some related articles from the Financial Post:

http://business.financialpost.com/tag/retirement-planning

About half of Canadians expect to be in debt when they retire

For more information on this topic and other areas of financial planning, see the library of articles found in: www.DytucoFinancialServices.com. Also watch out for other upcoming posts on:

- Tips on teaching your children about money

- Thinking beyond the typical “estate planning box”

- Business planning and how to avoid the top 3 mistakes made by start-up entrepreneurs

Please share this with a friend, family member or co-worker who might get value out of this information. Also feel free to contact me for a complimentary review of your financial plan or retirement plan. I can help you look at different & creative strategies to meet your specific needs for covering your risks, reaching your financial goals, and saving for your family & your retirement.

Remember, the time to repair the roof is when the sun is shining. (John F. Kennedy)

For a printer friendly version of the article, click: 4-steps-steps-to-catch-up-on-your-retirement-savings