To Term or not to Term? That is the question!

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs.

Many people are lured by cheap term premiums or permanent plans with an annually renewing cost of insurance. These can be quite inexpensive at the beginning, but usually involve significant premium increases later on. They can sometimes get to the point of being unaffordable, so I’ve seen people who’ve had to cancel their insurance when they’re older, just when their family really needs it the most.

So how do you decide on what type?

The quick answer is to first decide what you need covered and for how long.

In a nutshell, life insurance is meant to:

- cover your financial responsibilities in case of premature death, and

- facilitate a tax-free wealth transfer to future generations

Specifically, it can:

- Replace income in the event of the death of a wage earner

- Pay debts (such as a mortgage) on death

- Pay final expenses

- Pay tax due upon death

- Create, conserve, maximize or equalize an estate

- Provide an endowment to a charity

Additional benefits include:

- It allows you to pass on an inheritance to a specific person or entity (such as charity) directly, without passing through your estate (which is open to potential challenges)

- Keeps payments to beneficiaries private (as opposed to your Will which becomes public on your death)

- Avoids probate fees and other legal fees related to settlement of your estate

- Provides more immediate cash paid to your benefits, compared to the lengthy periods typically involved with settlement of an estate

- Pays directly to your beneficiaries free of other claims from your estate (except for potential taxes on RRSPs left to a beneficiary)

- Can be paid to a trust (e.g. for the care of young children)

There are two types of insurance:

- Term (Temporary)

- Permanent

Term Insurance

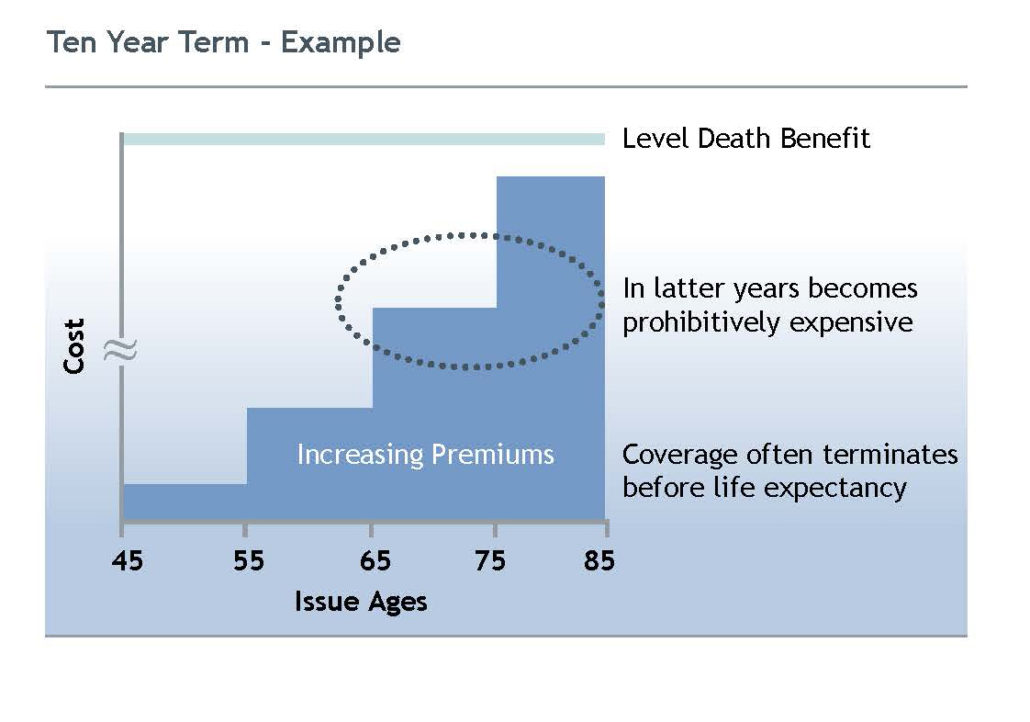

- Initially inexpensive but price increases dramatically with age

- Price increases at each term renewal

- Variety of term options available:

- Annual, 5 years, 10 years, 15 years, 20 years, 30 years

- To age 65 or age 75

- Finite – coverage ends at age 75-85 (depending on the insurance company) and often before life expectancy

When selecting a term product you should consider the time frame that you will need the coverage, and take into account when:

- Debts such as mortgages will be repaid

- Retirement savings will be fully funded

- Primary dependency period will end, especially children’s education

Permanent Insurance

There are five types of permanent insurance:

- Step Premium Permanent Insurance

- Term to 100 (T100)

- Universal life

- Whole life

- Hybrid Life

For all permanent plans, coverage stays in place until death, no matter the age.

Some types of permanent plans have cash values and some do not. Cash values include accumulated capital within the tax exempt fund and any guaranteed cash surrender values that are offered to the policyowner by the insurance company upon cancellation of the contract.

Depending on the type of policy established the total cash values, including the guaranteed portion, may be accessed by the policyowner through a number of different methods.

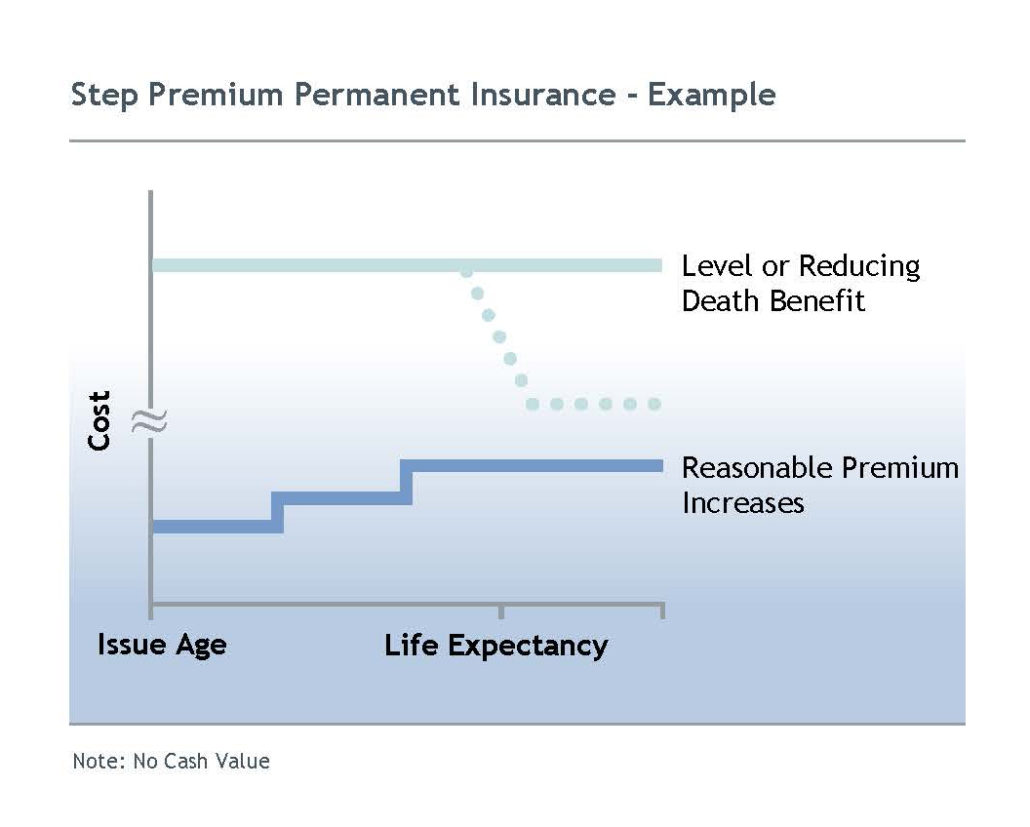

Permanent Insurance: Step Premium

- Premium and death benefit guaranteed

- Initial premiums are lower than traditional permanent insurance

- Premiums increase at renewal at rate guaranteed in the policy contract

- Accommodates short term needs at affordable premium

- Allows client time to grow into future premiums

- No cash values

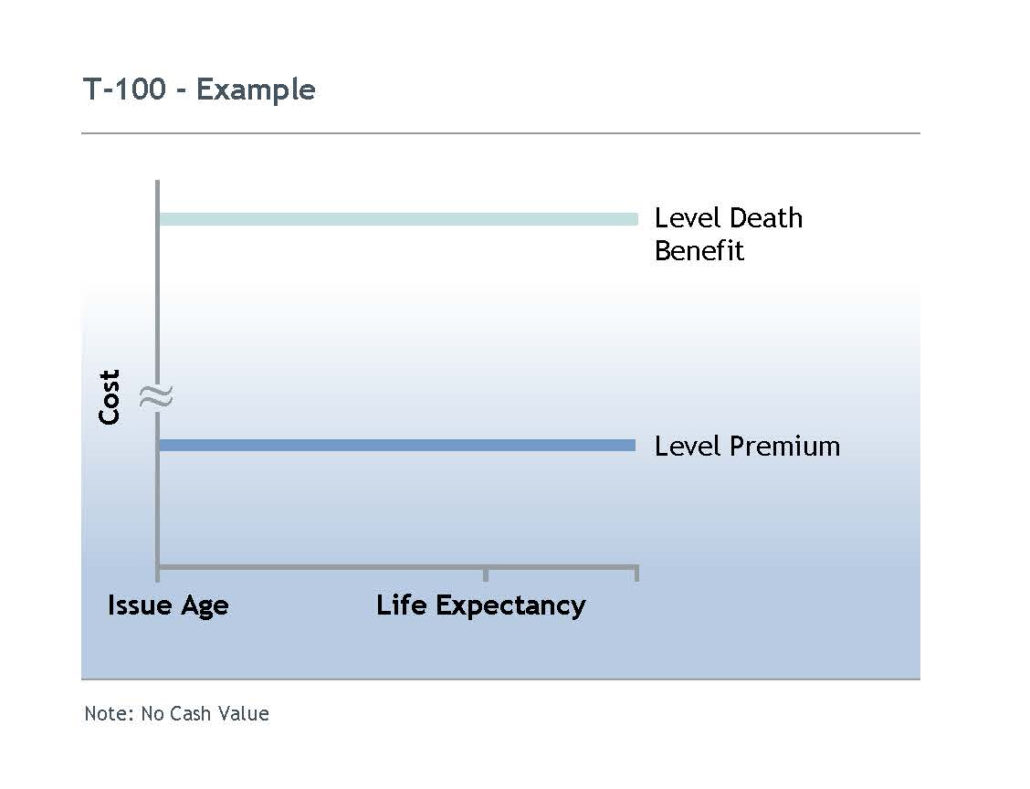

Permanent Insurance: T-100

- Both the premium and the death benefit are guaranteed and are level

- No cash values

- Premiums must be paid for lifetime, no paid up options

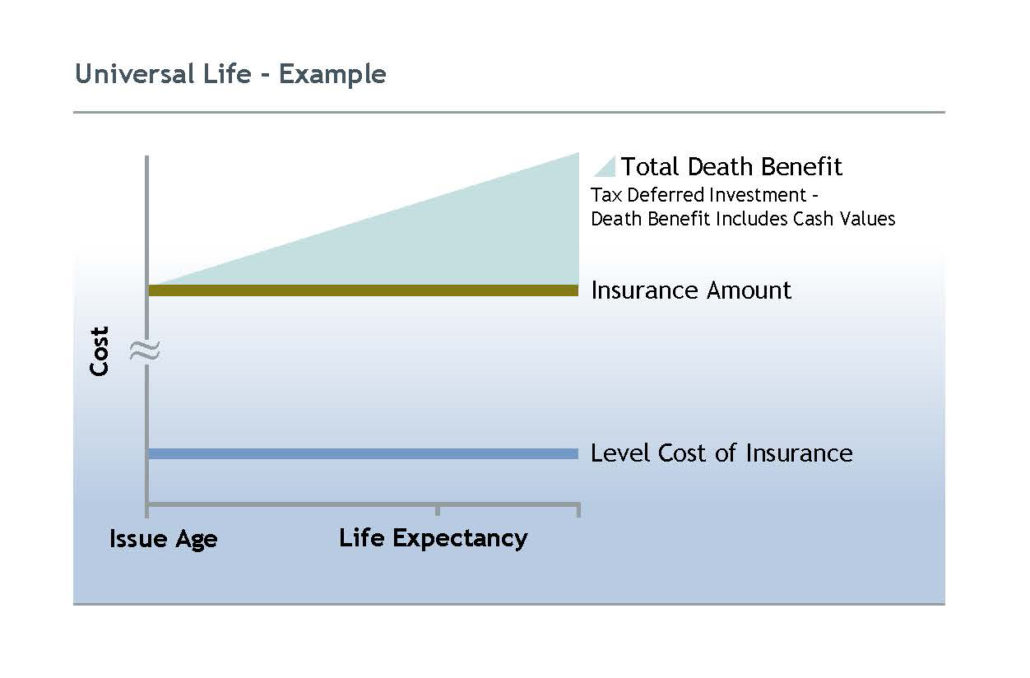

Permanent Insurance: Universal Life

- Cost of insurance is guaranteed in the policy contract

- The costs can be level for the lifetime of the policy or can increase as the insured ages

- Face amount of insurance is level and guaranteed

- Death benefit is a combination of the face amount of insurance and the value of investments

- Additional funds, above the cost of insurance, may be deposited

- The funds are invested at the discretion of the policy owner (not the insurance company) and include these options:

- Fixed income

- Stock market index accounts

- Mutual Fund mirrored accounts

- The earnings on the funds invested in the policy are exempt from tax, within certain limits outlined by CRA

- The funds stay in the policy and are paid out tax free as a death benefit

- Funds can be accessed by loan, withdrawal, disability benefit or fund value payout

- It is possible to have sufficient funds in the policy to pay insurance charges, thus creating a policy with no further premium requirements

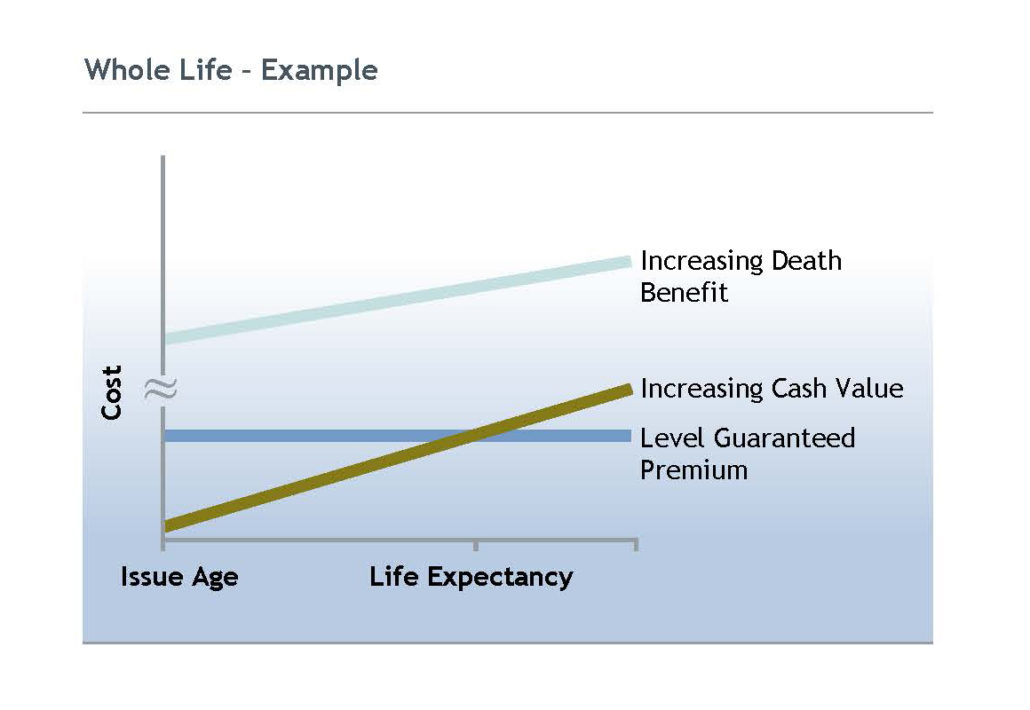

Permanent Insurance: Whole Life

- Premiums are guaranteed

- Minimum face amount is guaranteed

- Policy will have a minimum guaranteed cash value

- Premium paying period may be guaranteed, for a period of years or to age 100

- Paid up additions allow for increasing life insurance coverage

- Investment of the cash value is determined by the insurance company, not the policy owner

- Policy owner shares in the earnings of the participating investment fund via dividends

- The dividend is a result of smoothing the investment performance of the participating fund

- Policy may pay dividends (at the discretion of the insurance company) which can be used to reduce future premiums, purchase more insurance or to increase the cash value

- Cash value can be accessed by way of a policy loan or through a withdrawal by a surrender of all or part of the insurance coverage

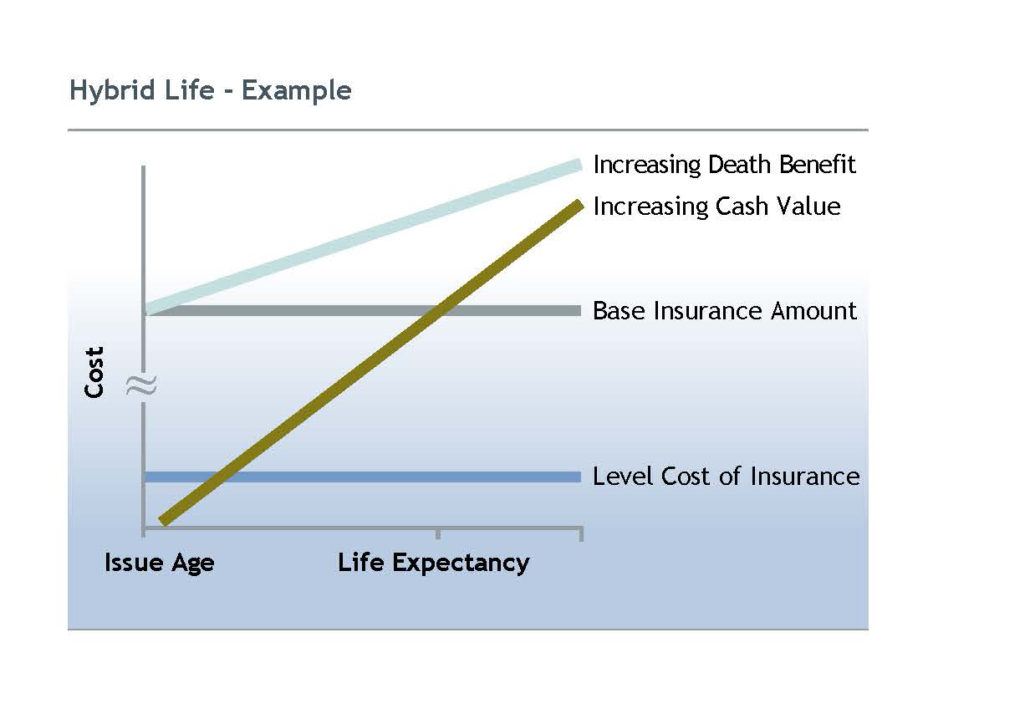

Permanent Insurance: Hybrid Life

A hybrid life insurance policy offers a unique combination of the best elements of traditional whole life and universal life insurance.

- Cost of insurance is guaranteed not to increase

- Death benefit is a combination of the base insurance amount, additional paid up coverage and the value of investments

- Policy has contractually guaranteed cash values

- Additional funds, above the cost of insurance, may be deposited

- The funds are invested at the discretion of the policy owner (not the insurance company) and include these options:

- Fixed income

- Stock market index accounts

- Mutual Fund mirrored accounts

- Smoothed return investment account

- The earnings on the funds invested in the policy are exempt from tax, within certain limits outlined by CRA

- The funds stay in the policy and are paid out tax free as a death benefit

- Cash value can be accessed by loan, withdrawal, disability benefit or fund value payout

- It is possible to have sufficient funds in the policy to pay insurance charges, thus creating a policy with no further premium requirements

- Policy is adaptable to meet life’s unexpected changes

Hybrid Life Insurance – Changes with your Life

While an insurance program is based on your needs today, life’s unexpected changes and developments in the world around you can mean you need to adjust your strategy.

Let’s look at some potential changes and how a hybrid life insurance policy can be adapted to meet those changes.

Changes in Your Insurance Requirements

An addition to your family or a business opportunity are just two of the changes you may be faced with. A hybrid life insurance policy can provide a number of options.

1.Paid-up additional insurance amounts can be purchased annually thus increasing the base coverage.

2.Term riders can be renewed at rates guaranteed within the policy contract.

3.Term riders can be converted to permanent insurance, effectively increasing the amount of the base policy.

Changes in Family Finances

- Although not planned, an illness or loss of job can cause financial strains for the family. A hybrid life insurance policy offers a number of features that can help through these periods:

- 1.Sufficient equity in the policy would allow you to take a premium holiday and skip a premium without losing your insurance coverage. Alternatively, you could temporarily reduce the deposit level into the policy until your financial situation improves.

- 2.In the case of a disability, you can withdraw all or part of the Accumulation Fund on a tax free basis. If this provision is used, in order to retain the life insurance coverage, you may need to continue with premium deposits.

- 3.Use the equity in the policy to secure credit from a bank or other lending institution.

New Business or Investment Opportunities

- When business or investment opportunities present themselves, you may need the resources to take advantage of them. With a hybrid life insurance policy the asset you are building can be utilized towards those opportunities.

- Unlock the growing equity in your policy:

> Use the policy as collateral at a lending institution. Most institutions will recognize up to 90% of the total cash surrender value in your plan.

> Withdraw some funds from the accumulation fund in the plan. (With a withdrawal, tax may be payable on part or all of the withdrawal.)

Changes to your Estate Objectives

- While you are purchasing insurance today to protect your family or business, over time the reason for your insurance requirement may change.

- A hybrid life insurance policy has a feature that can be used to change the character of the insurance coverage.

- For example, the coverage can go from single life to joint and last to die (with your spouse). This modification reduces the cost of the insurance and often results in an increase in the accumulation fund due to the release of cash surrender value from the base coverage and any paid up addition coverage.

Hybrid Life Insurance – Changes with the World

Changes to the world around you may also necessitate flexibility in your insurance program.

Changing Market Trends

A hybrid life insurance policy has a wide variety of investment choices that allow you to take advantage of the changing investment environment over the term of the contract. Having the ability to mix fixed rate investments and index accounts with a “smoothed” investment account allows diversification and the ability to invest with market trends.

Improvements in Market Returns

- Most life insurance policies are priced assuming conservative long term investment returns. Hybrid life insurance policies allow you to benefit from any improvements in those assumptions through the use of contractual bonus provisions. With these policies you have the security of guaranteed pricing, but will benefit if there is an increase in long term investment returns.

Economic Deviations

- Changing economic environments may impact the ideal method of accessing the cash values of the policy. Hybrid life insurance offers a number of different choices including policy withdrawals, policy loans, tax free disability benefits and tax free fund value payout.

- Any or all of these ways can be chosen with the decision on which manner to use determined at the time the cash value is required.

Who Should Buy Term Insurance?

Individuals looking for:

- Coverage for short (10-20 years) periods of time

- Mortgage repayment

- Debt repayment

- Income replacement, or

- Protection for any temporary need

Who Should Buy Permanent Insurance?

Individuals looking for:

- Coverage that will last for a lifetime

- Opportunity to accumulate investment capital

- Estate creation, conservation, maximization or equalization

- A way to insure an annuity or maximize a pension

- A way to provide an endowment to a charity, or

- Protection for any permanent need

Some Important Notes

This presentation is for general information purposes. The information contained in this presentation must not be taken or relied upon by the reader as legal, accounting, taxation or actuarial advice. For these matters readers should seek independent professional advice. Please refer to insurance company illustrations, policy contracts and information folders regarding any insurance matters referred to in this presentation.

Click here for a printer-friendly version of this article: Life-Insurance-options-rev

For more information on this topic and other areas of financial planning, see the library of articles found in: www.DytucoFinancialServices.com. Also watch out for other upcoming posts on:

- Tips on teaching your children about money

- Thinking beyond the typical “estate planning box”

- Business planning and how to avoid the top 3 mistakes made by start-up entrepreneurs

Please share this with a friend, family member or co-worker who might get value out of this information. Also feel free to contact me for a complimentary review of your financial plan or retirement plan. I can help you look at different & creative strategies to meet your specific needs for covering your risks, reaching your financial goals, and saving for your family & your retirement.

Remember, the time to repair the roof is when the sun is shining. (John F. Kennedy)