Beyond Tax-Savings: The Benefits of an Estate Bond for your Estate Beneficiaries

This financial planning strategy replaces your taxable investments with tax-free insurance benefits to your heirs, by-passing your estate and probate fees and keeps this portion of your legacy gifts private.

Understanding your life insurance options

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs. This document can help you understand the different types of insurance options and how to select the type of plan that best suits your needs for coverage.

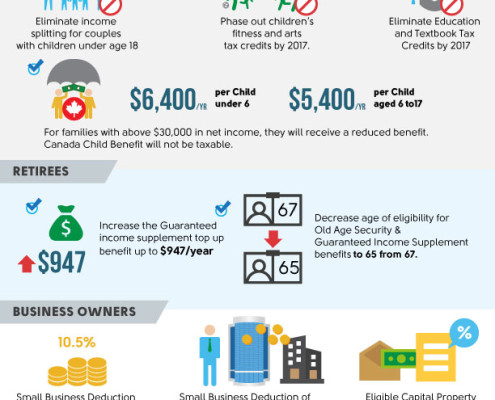

Federal Budget 2016

The Honourable Bill Morneau, Minister of Finance, recently…

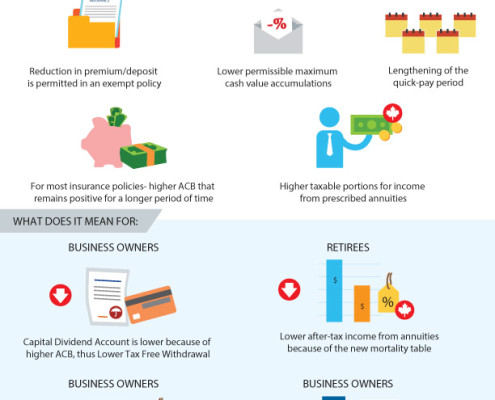

Tax-Exempt Legislation Changes

The tax-exempt changes to life insurance become effective Jan 2017. Having the appropriate plans in place can therefore be significantly more beneficial to you if ISSUED in 2016, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

Estate Planning for Real Estate Investors

For many Canadians the majority of their wealth is held in personally owned real estate. For most this will be limited to their principal residence, however, investment in recreational and real estate investment property also forms a substantial part of some estates. Due to the nature of real estate, it is important to utilize estate planning to realize optimum gain and minimize tax implications.

Leave a Financial Legacy for your family and less taxes for the government

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

5 KEY STEPS TO REACHING YOUR FINANCIAL GOALS THIS YEAR & BEYOND

Albert Einstein defines insanity as doing something over & over again and expecting different results. What have you been doing over & over the last few years that has not moved you closer to your financial goals? Why even bother with new years’ resolutions if you’ve usually just abandoned them after a few weeks? These 5 key steps gives a different perspective that can truly make a big difference to reaching your financial goals this year and beyond.

TFSA or RRSP?

RRSP or TFSA

Taxation Changes for Life Insurance Create Tax-Savings Opportunities in 2016

Permanent life insurance, such as Whole Life or Universal Life, has long been accepted as a tax efficient way of accumulating cash for future needs. Soon the amount of funds that can be tax sheltered within a life insurance policy will be reduced by new tax rules which take effect January 1, 2017. These changes may make 2016 the best year to buy cash value life insurance.

Critical Illness: Are you Protected?

Medical practitioners today will confirm that the lower your stress levels the better the chances for your recovery. When one is ill with a serious illness, having one less thing to deal with, such as financial worry, can only be beneficial.

Your Life Could Change in a Minute!