Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

Canada Emergency Wage Subsidy expanded to include more businesses!

On July 17th, Finance Minister Bill Morneau announced proposed changes to the Canada Emergency Wage Subsidy (CEWS) that will expand the number of businesses that qualify for the program.

Canada Emergency Wage Subsidy extended into December!

On July 13th, Prime Minister Justin Trudeau announced the extension of the Canada Emergency Wage Subsidy (CEWS) until December.

CERB Extended | Business Owners who did not qualify previously – expanded CEBA starts June 19th

Great news for Canadians out of work and looking for work. The CERB will be extended another 8 weeks for a total of up to 24 weeks.

The expanded CEBA will begin June 19th.

Small Businesses! Applications for Canada Emergency Commercial Rent Assistance starts May 25th

The Application portal for the Canada Emergency Commercial Rent Assistance (CECRA) opens at 8:00am EST on May 25th

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

2020 Financial Facts for Business Owners

2020 Financial Facts for Business Owners include Interest Rate, Corporate Tax Rates, Employment Insurance Premium Rates, CPP Contribution Rates, Corporate Investment, Income Tax Rate, Limits

Insurance- Types that are needed, Lifetime Capital Gains Exemptions

2018 Federal Budget Highlights for Business

The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC). (Previously proposed in July 2017.)

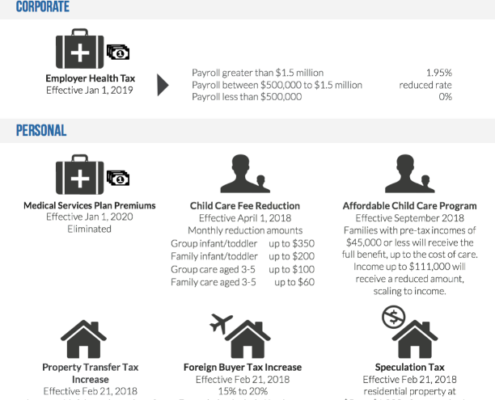

BC Budget Highlights 2018

BC Finance Minister Carole James delivered the province's 2018 budget update on February 20, 2018. The budget anticipates a surplus of $219 million for the current year, $281 million for 2019 and $284 million in 2020.