A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.

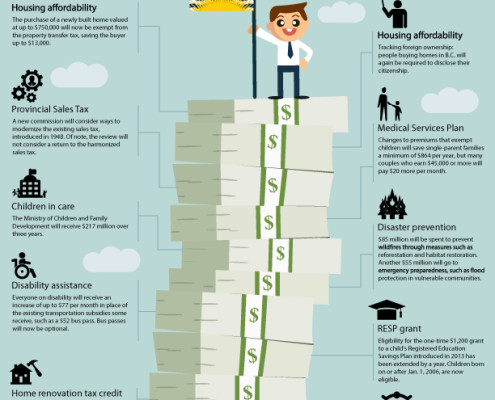

BC Budget Changes

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

Estate Planning for Real Estate Investors

For many Canadians the majority of their wealth is held in personally owned real estate. For most this will be limited to their principal residence, however, investment in recreational and real estate investment property also forms a substantial part of some estates. Due to the nature of real estate, it is important to utilize estate planning to realize optimum gain and minimize tax implications.

Leave a Financial Legacy for your family and less taxes for the government

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

How to select Mortgage Insurance that gives you more benefits

See how getting your own coverage gives you & your family more benefits compared to getting Mortgage Insurance from your lender.

A few seconds that can change your life

A few seconds could change your life - in a good way, or a bad way. My close call could have led to a much worse situation that could have severely affected my quality of life. So while we could all go through unfortunate situations that we can’t avoid, planning for the unexpected can help reduce the adverse impact on our quality of life.

5 KEY STEPS TO REACHING YOUR FINANCIAL GOALS THIS YEAR & BEYOND

Albert Einstein defines insanity as doing something over & over again and expecting different results. What have you been doing over & over the last few years that has not moved you closer to your financial goals? Why even bother with new years’ resolutions if you’ve usually just abandoned them after a few weeks? These 5 key steps gives a different perspective that can truly make a big difference to reaching your financial goals this year and beyond.

10 often overlooked places to look for savings

When you search the internet for articles on the saving money, most usually say the same old obvious suggestions like turning lights off, turning the thermostat down and bringing your lunch to work.

This article highlights some not-so-common places to look for savings - in some very common ways we “waste” money. As you read through the list, think about how much these may have cost you in the past, or imagine how much they could cost you in the future. As you add it all up, you may find that you have a hidden pot of gold right under your fingertips.

TFSA or RRSP?

RRSP or TFSA

Taxation Changes for Life Insurance Create Tax-Savings Opportunities in 2016

Permanent life insurance, such as Whole Life or Universal Life, has long been accepted as a tax efficient way of accumulating cash for future needs. Soon the amount of funds that can be tax sheltered within a life insurance policy will be reduced by new tax rules which take effect January 1, 2017. These changes may make 2016 the best year to buy cash value life insurance.