2022 Financial Calendar

Looking for an "at a glance" document covering all the important dates you need to know to stay on track with your financial planning in 2022?

Our 2022 financial calendar (which you can easily bookmark or print out) makes sure you're always in the loop! It lists important dates, including:

• Payments dates for the Canada Child Benefit, CPP, OAS, and the GST/HST credit.

• When TFSA contribution room starts again.

• Tax filing deadlines.

• Charitable contribution deadlines and the last day to contribute to registered investment accounts.

• When the Bank of Canada interest rate announcements are.

Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

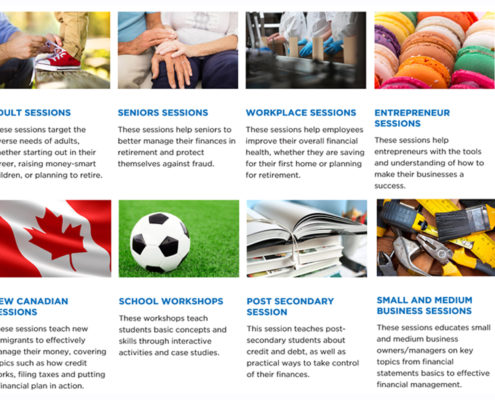

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

A Group Workshop: Early Retirement Planning for Nurses & MPP (Pension Plan) Members

Learn some tax-efficient ways to supplement your early retirement pension while doing what you love.

Creative Retirement Planning – My Personal Example

Here's a personal example of my creative retirement plan that has me using what I love to do (travel) to support the life that I want to live - without taking on another JOB!

A Different Perspective on Teaching your Children to be Empowered about Money

Parents who believe that it’s important to teach children “about money” know that this is an important part of helping them be successful in life. Many however find it difficult because they think their children are too young and/or not interested, and they themselves are too busy with life in general. In reality, you are continually teaching them because they learn more from what you do than what you say.

Video: A Different Perspective on Early Retirement Planning for Nurses

A video for Nurses on the MPP (pension plan) who want to retire early. It provides a different perspective to make up the difference between the early retirement pension and full pension - through tax-efficient solutions that reduce taxes and help avoid claw backs of government credits!

Video: A Different Perspective on Retirement Planning for Professional Women

A video about a different perspective on retirement planning for professional women who've been too busy to plan for their retirement, or are just tired of the same old, same old financial advice.

Workshop: A Different Perspective on Early Retirement Planning for Nurses

Why the focus on Nurses? Primarily because from what I've seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket - so a lot of that extra money you've earned just goes to paying extra taxes. So how do you retire early when you know you'll be getting a reduced pension? By finding tax-efficient ways to cover that gap to reduce taxes and avoid claw backs of government pension!