A New Year’s Resolution You Shouldn’t Break

Many of us set New Year’s resolutions for ourselves and often those resolutions have to do with finances. January is the month we say, “Ok, this year I am going to save more and spend less”.

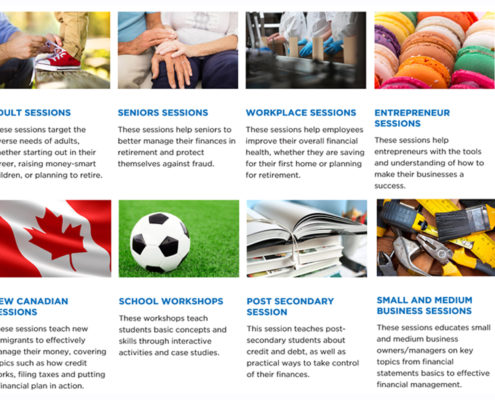

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

A Group Workshop: Early Retirement Planning for Nurses & MPP (Pension Plan) Members

Learn some tax-efficient ways to supplement your early retirement pension while doing what you love.

Creative Retirement Planning – My Personal Example

Here's a personal example of my creative retirement plan that has me using what I love to do (travel) to support the life that I want to live - without taking on another JOB!

Video: A Different Perspective on Early Retirement Planning for Nurses

A video for Nurses on the MPP (pension plan) who want to retire early. It provides a different perspective to make up the difference between the early retirement pension and full pension - through tax-efficient solutions that reduce taxes and help avoid claw backs of government credits!

Video: A Different Perspective on Retirement Planning for Professional Women

A video about a different perspective on retirement planning for professional women who've been too busy to plan for their retirement, or are just tired of the same old, same old financial advice.

Workshop: A Different Perspective on Early Retirement Planning for Nurses

Why the focus on Nurses? Primarily because from what I've seen of your pension plan, many of you will have good pension income when you retire. Many of you also work overtime which can leave you exhausted and at a higher tax bracket - so a lot of that extra money you've earned just goes to paying extra taxes. So how do you retire early when you know you'll be getting a reduced pension? By finding tax-efficient ways to cover that gap to reduce taxes and avoid claw backs of government pension!

The Benefits of Converting Your Term Insurance to a Permanent Plan

Permanent life insurance can be a very effective estate planning & tax saving tool for your family and business. Converting an existing term insurance to permanent is an easy way to get that permanent coverage - and with the tax rules changing Jan 2017, you get a lot more tax-free benefits if you convert this year.

Creative Retirement Planning Workshop for Professional Women

Tired of every other financial advisor just moving your money from one investment to another and telling you to stop buying your favorite coffee? When you work with me, we'll first look at your vision of your ideal life at retirement, then explore different financial solutions to help you use doing what you love to save on taxes so you can keep more of your hard-earned money!

The Clock is Ticking so Don’t Miss the Deadline for Higher Tax Savings

2016 is an opportune year to buy life insurance. After this date, certain new policies will not have as much tax-free benefits as they currently do. This means policies approved and issued in 2016 are grandfathered with the higher tax-free benefits, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.