Creative Risk Management Planning for your Business

Many would agree that two of the greatest risks to the sustainability of a business are: not having enough money to keep the company going in times of lower income, and losing the ability to make money. Here are some essential tax-savings & risk management strategies to keep your business going during medical emergencies, save you taxes and leave more money in your pocket.

A Tax Savings Solution Using a Corporate Health Plan

The small business corporate tax rates can be quite a bit lower than an individual's income tax rates, especially as you take more money out of your company. So you can usually save taxes by using of corporate dollars whenever possible. Here's one great idea using your corporation to save on taxes - while also reducing the risk of health issues affecting the sustainability of your company.

Understanding your life insurance options

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs. This document can help you understand the different types of insurance options and how to select the type of plan that best suits your needs for coverage.

What are your risks of paying higher taxes in an emergency?

Your most valuable asset is your ability to earn income. What are the chances of you being unable to work due to accident or illness? What about the risk of paying higher taxes if you're relying on withdrawing RRSPs for additional monies required - to pay for extra medical and non-medical expenses? What about if you have to get extra help or your family has to reduce work hours to help you out?

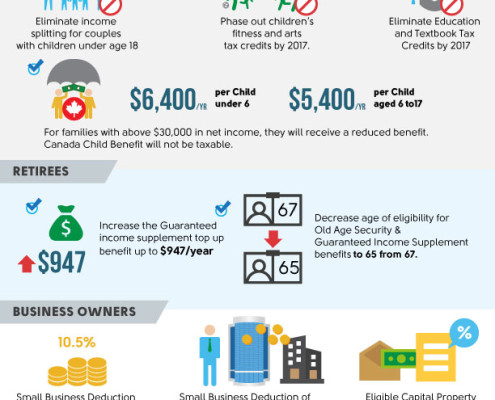

Federal Budget 2016

The Honourable Bill Morneau, Minister of Finance, recently…

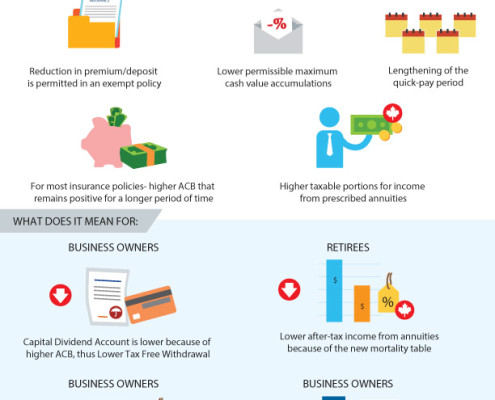

Tax-Exempt Legislation Changes

The tax-exempt changes to life insurance become effective Jan 2017. Having the appropriate plans in place can therefore be significantly more beneficial to you if ISSUED in 2016, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.

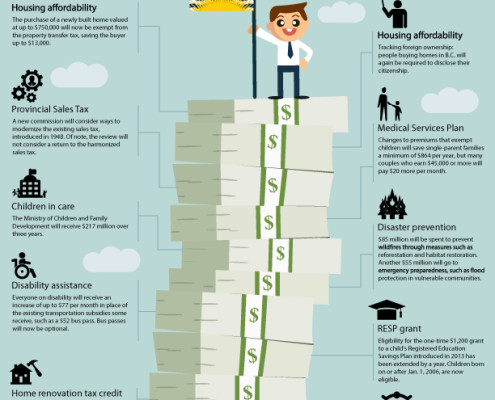

BC Budget Changes

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

Leave a Financial Legacy for your family and less taxes for the government

If your plans involve doing well financially and leaving an inheritance for future generations, look at using life insurance to transfer wealth tax-free. This would seem preferable to leaving a big chunk of your hard earned money for the government. It also protects your money from probate and claims or "challenges" made to your Will.

How to pay less taxes when you withdraw from your RRSP or RRIF (at retirement)

It‘s been said that one of the best tax-savings tools is also one of least known, least understood, and most under-utilized financial instruments (yes, that’s the Annuity).