Creative Risk Management Planning NOW can keep your business going through tough times & save you taxes.

So how tax-efficient is your plan B?

You’d probably agree that two of the greatest risks to the sustainability of a business are:

- not having enough money to keep the company going in times of lower income, and

- losing the ability to make money

So life and health insurance naturally comes to mind, but it really provides so much more than just protection. Here are some essential tax-savings & risk management strategies to keep your business going during medical emergencies and leave more money in your pocket.

A recent article published in the Globe & Mail1 says:

“Life insurance isn’t taboo. It’s a creative tool. Think about life insurance not as an unnecessary cost, but as an investment to accomplish some important and beneficial things – both during your lifetime and when you’re gone.”

The article describes a few of these benefits, which I think groups into these 3 categories:

– tax savings (for wealth transfer and living benefits)

– risk coverage (against the risk of disability or premature death)

– liquidity (typically way faster than settling an estate or selling assets)

1 http://www.theglobeandmail.com/globe-investor/personal-finance/taxes/life-insurance-isnt-taboo-its-a-creative-tool/article30927193/ Written by Tim Cestnick Special to The Globe and Mail Published Thursday, Jul. 14, 2016

TAX SAVINGS

Since corporate tax rates are quite a bit lower than personal rates, paying for your health and life insurance through your company saves you taxes. Even though you can’t (or shouldn’t) use premiums as a tax deductible expense (so your benefits stay tax free), you’re still saving the difference between corporate tax rates of about 11% and your personal tax rates which can go as high as 47.7% (as of 2016).

Many small businesses and even accountants are familiar with only a few of the tax-savings benefits of life insurance. My own recent poll of accountants also showed that many are not familiar with the not-so-basic but can-be-very-effective solutions, especially for those who are incorporated, and as it involves critical illness insurance.

Bottom line is if you’re making $100,000 taxable personal income, you’re at a 38% marginal tax rate (BC & Federal combined). That means you need to make $162 to end up with $100 in your pocket.

Two Ideas:

- Invest in a corporate owned Critical Illness plan with a return of premium – This saves quite a bit of taxes even when compared to the alternative of taking earnings out as dividends. (See my calculations on the full article posted on my website: https://dytucofinancialservices.com/corporate-health-plan-tax-savings-solution/)

- Invest in a corporate owned life insurance policy – This allows tax-free benefit payments to shareholders through the Capital Dividend Account.

TIP: Be aware that the tax rules are changing effective Jan 2017, which provides a significantly greater benefit to policies approved and in place before then. (See my full article on this tax legislation change: https://dytucofinancialservices.com/tax-exempt-legislation/)

RISK COVERAGE

Your Most Valuable Asset is Your Ability to Earn Income

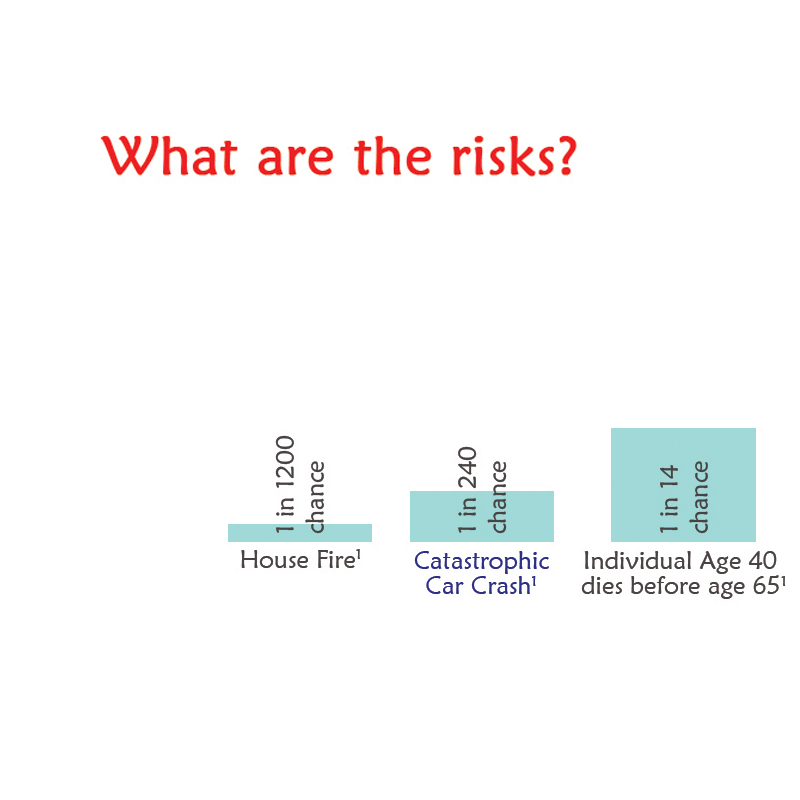

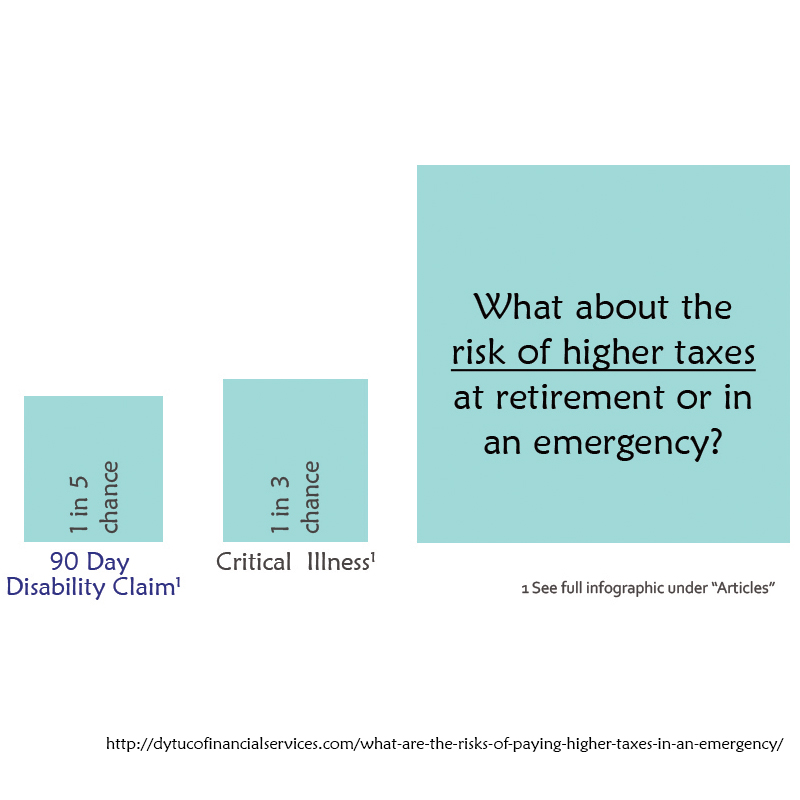

So if you or your key employees are not able to do the work needed to keep the company going, you at least need some cash to pay for the bills, get extra help and keep even the minimum going while you/they recover. That emergency money of course helps a lot more when it’s tax-free. (For more details see: https://dytucofinancialservices.com/what-are-the-risks-of-paying-higher-taxes-in-an-emergency/)

LIQUIDITY

As mentioned above, having enough money to keep the company going is essential. In an event of a medical emergency, the last thing you want to be dealing with is the stress of figuring out what to sell or cash out to pay for the bills, and having to pay more taxes (for example, if you withdraw from your RRSPs).

Insurance benefits provide more immediate cash when you need it – either with critical illness policies (with typical waiting periods of 30 days), disability insurance (based on the waiting period you select), and life insurance (which pay months or years faster than estate settlements). This is especially true for policies in-force past the 2-year contestability period (when insurance companies investigate to find out if you made any material misrepresentations on your policy application).

Remember, the time to repair the roof is when the sun is shining. (John F. Kennedy)

For more information on this topic and other areas of financial planning, see the library of articles found in: www.DytucoFinancialServices.com. Also watch out for other upcoming posts on:

- Tips on teaching your children about money

- Thinking beyond the typical “estate planning box”

- Business planning and how to avoid the top 3 mistakes made by start-up entrepreneurs

Please share this with a friend, family member or co-worker who might get value out of this information. Also feel free to contact me for a complimentary review of your financial plan or retirement plan. I can help you look at different & creative strategies to meet your specific needs for covering your risks, reaching your financial goals, and saving for your family & your retirement.

Click here for a copy of the printer friendly article: Creative-Risk-Management-Planning-for-your-Business-print