Posts

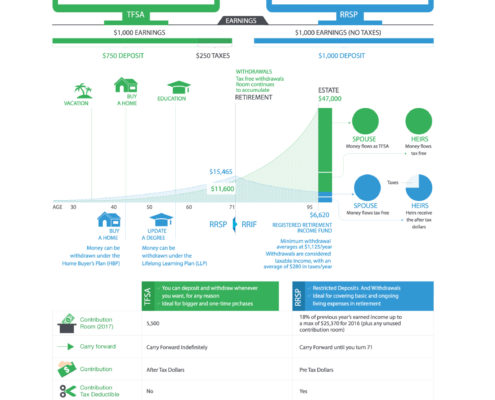

TFSA or RRSP: What’s the difference?

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest.

Do You Need Individual Life Insurance?

In a recent study conducted by the Life Insurance and Market Research Association (LIMRA), it was reported that61% of Canadians hold some form of life insurance. Surprisingly, it also revealed that only 38% of Canadians own an individual life insurance contract.

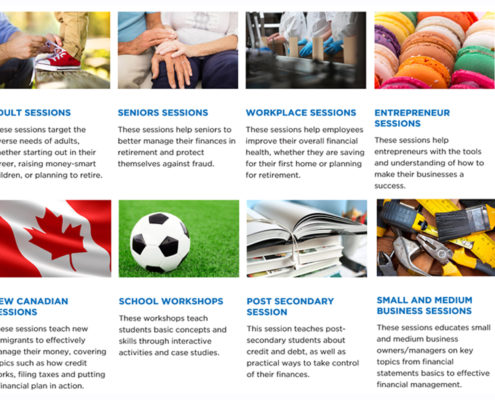

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

What is Key Person Insurance?

Most business owners understand that assets vital to the success of the enterprise should be insured. Premises are routinely covered for fire and/or theft; vehicles used to make deliveries, insured; machinery needed for manufacturing, also insured. Given that these tangible assets are instrumental in the success of the business, it makes good business sense that the business is protected in the event of a loss. But what about key employees? Many business owners overlook the impact on their business should a key employee die unexpectedly.

Creative Retirement Planning – My Personal Example

Here's a personal example of my creative retirement plan that has me using what I love to do (travel) to support the life that I want to live - without taking on another JOB!

Creative Retirement Planning Workshop for Professional Women

Tired of every other financial advisor just moving your money from one investment to another and telling you to stop buying your favorite coffee? When you work with me, we'll first look at your vision of your ideal life at retirement, then explore different financial solutions to help you use doing what you love to save on taxes so you can keep more of your hard-earned money!

Creative Risk Management Planning for your Business

Many would agree that two of the greatest risks to the sustainability of a business are: not having enough money to keep the company going in times of lower income, and losing the ability to make money. Here are some essential tax-savings & risk management strategies to keep your business going during medical emergencies, save you taxes and leave more money in your pocket.

Pay Attention to Your Beneficiary Designation

Naming a beneficiary is a valuable feature of life insurance and segregated funds policies so it is important to carefully choose your beneficiaries.

A Tax Savings Solution Using a Corporate Health Plan

The small business corporate tax rates can be quite a bit lower than an individual's income tax rates, especially as you take more money out of your company. So you can usually save taxes by using of corporate dollars whenever possible. Here's one great idea using your corporation to save on taxes - while also reducing the risk of health issues affecting the sustainability of your company.

Beyond Tax-Savings: The Benefits of an Estate Bond for your Estate Beneficiaries

This financial planning strategy replaces your taxable investments with tax-free insurance benefits to your heirs, by-passing your estate and probate fees and keeps this portion of your legacy gifts private.