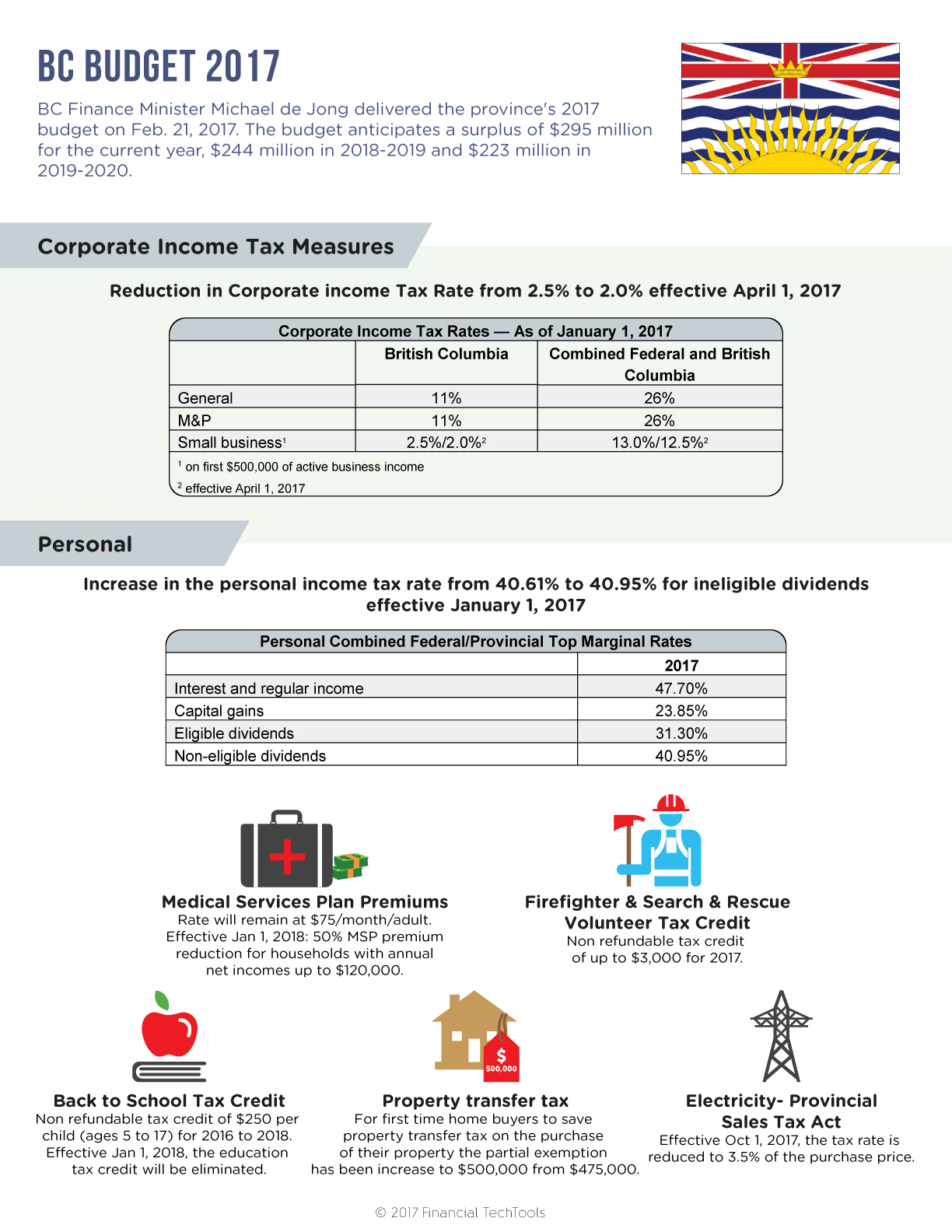

BC Budget 2017

BC Finance Minister Michael de Jong delivered the province’s 2017 budget on Feb. 21, 2017. The budget anticipates a surplus of $295 million for the current year, $244 million in 2018-2019 and $223 million in 2019-2020.

Corporate Income Tax Measures

Reduction in Corporate income Tax Rate from 2.5% to 2.0% effective April 1, 2017

| Corporate Income Tax Rates- As of January 1, 2017 | ||

| British Columbia | Combined Federal & BC | |

| General | 11% | 28% |

| M&P | 11% | 26% |

| Small Business* | 2.5%/2.0%** | 13.0%/12.5%** |

| *on first $500,000 of active business income **effective April 1, 2017 | ||

Personal

Increase in the personal tax rate from 40.61% to 40.95% for ineligible dividends effective January 1, 2017.

| Personal Combined Federal/Provincial Top Marginal Rates | ||

| 2017 | ||

| Interest and regular income | 47.70% | |

| Capital gains | 23.85% | |

| Eligible dividends | 31.30% | |

| Non-eligible dividends | 40.95% | |

Medical Services Plan Premiums: Rate will remain at $75/month/adult. Effective Jan 1, 2018: 50% MSP premium reduction for households with annual net incomes up to $120,000.

Firefighter & Search & Rescue Volunteer Tax Credit: Non-refundable tax credit of up to $3,000 for 2017.

Back to School Tax Credit: Non-refundable tax credit of $250 per child (ages 5 to 17) for 2016 to 2018. Effective Jan 1, 2018, the education tax credit will be eliminated.

Electricity- Provincial Sales Tax Act: Effective Oct 1, 2017, the tax rate is reduced to 3.5% of the purchase price.

Property transfer tax: For first time home buyers to save property transfer tax on the purchase of their property the partial exemption has been increased to $500,000 from $475,000.