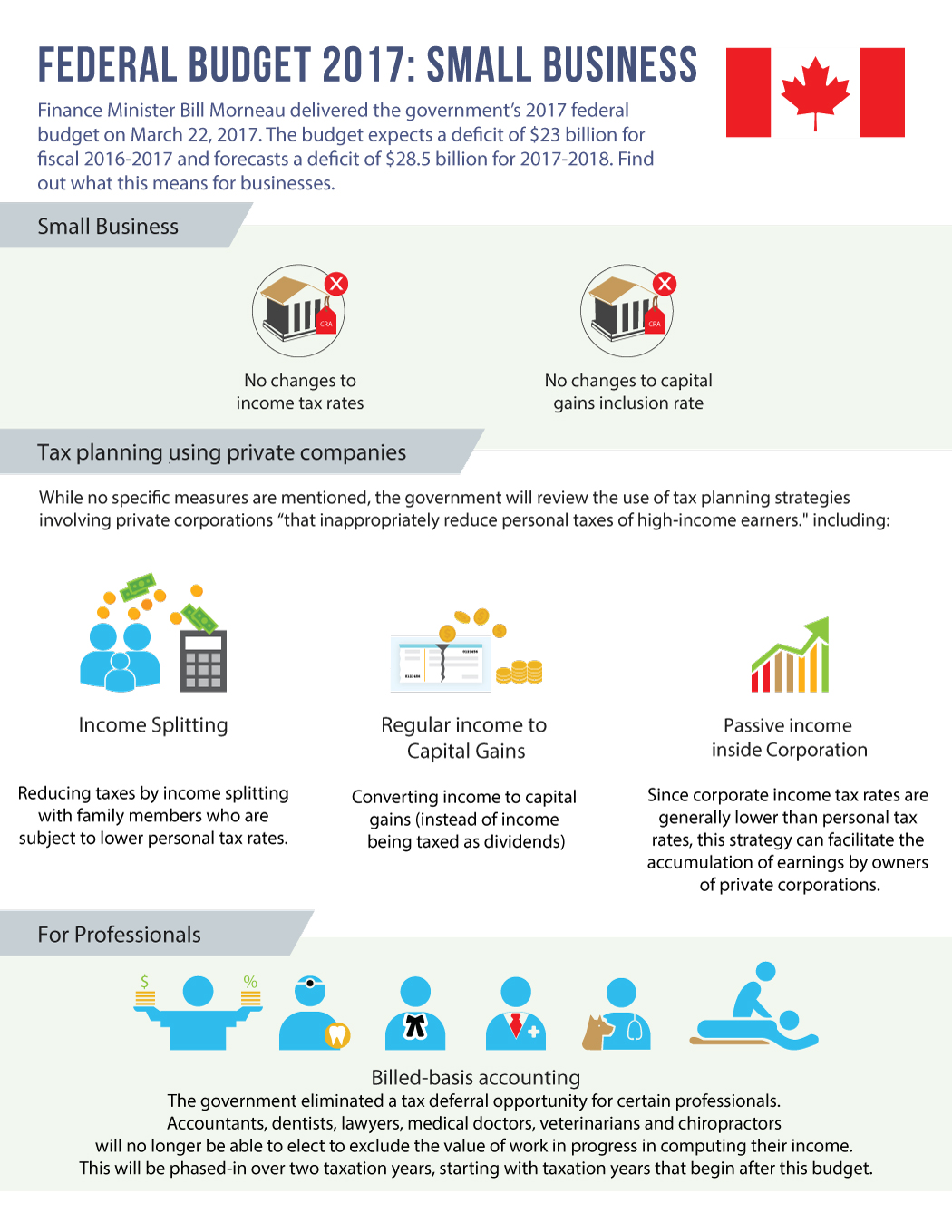

Federal Budget 2017: Business

Finance Minister Bill Morneau delivered the government’s 2017 federal budget on March 22, 2017. The budget expects a deficit of $23 billion for fiscal 2016-2017 and forecasts a deficit of $28.5 billion for 2017-2018. Find out what this means for businesses.

Small Business

- No changes to income tax rates

- No changes to capital gains inclusion rate

Tax Planning using private companies

While no specific measures are mentioned, the government will review the use of tax planning strategies involving private corporations “that inappropriately reduce personal taxes of high-income earners.” including:

- Income Splitting: Reducing taxes by income splitting with family members who are subject to lower personal tax rates.

- Regular income to Capital Gains: Converting income to capital gains (instead of income being taxed as dividends)

- Passive income inside Corporation: Since corporate income tax rates are generally lower than personal tax rates, this strategy can facilitate the accumulation of earnings by owners of private corporations.

For Professionals

The government eliminated a tax deferral opportunity for certain professionals. Accountants, dentists, lawyers, medical doctors, veterinarians and chiropractors will no longer be able to elect to exclude the value of work in progress in computing their income. This will be phased-in over two taxation years, starting with taxation years that begin after this budget.

Please don’t hesitate to contact us if you have any questions.