Expanded eligibility for Canada Emergency Response Benefit (CERB) & Boosted wages for Essential Workers

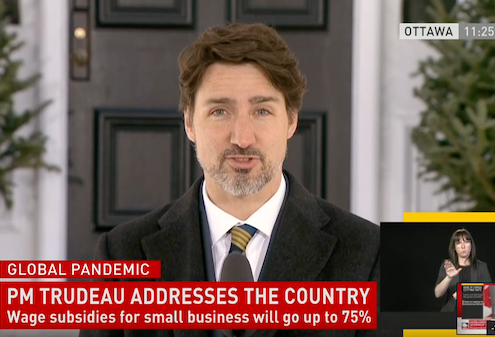

Prime Minister Justin Trudeau announced:

"Today, we're announcing more help for more Canadians. This includes topping up the pay of essential workers. At the same time, we'll also be expanding the Canada Emergency Response Benefit to reach people who are earning some income as well as seasonal workers who are facing no jobs and for those who have run out of EI recently. Expanding the CERB to include people who earn up to $1,000 per month. Maybe you're a volunteer firefighter, or a contractor who can pickup some shifts, or you have a part-time job in a grocery store."

Applications for the Canada Emergency Business Account starts TODAY!

The new Canada Emergency Business Account (CEBA) is available starting TODAY and is available through major banking institutions.

The CEBA will provide qualifying businesses an interest-free loans of up to $40,000 until December 31, 2022.

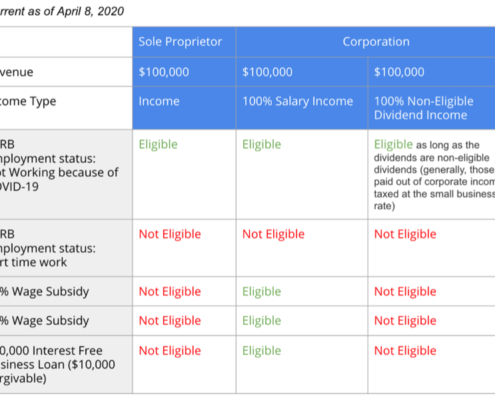

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

March 27, 2019 - Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

2020 Financial Facts for Business Owners

2020 Financial Facts for Business Owners include Interest Rate, Corporate Tax Rates, Employment Insurance Premium Rates, CPP Contribution Rates, Corporate Investment, Income Tax Rate, Limits

Insurance- Types that are needed, Lifetime Capital Gains Exemptions

2018 Federal Budget Highlights for Business

The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC). (Previously proposed in July 2017.)

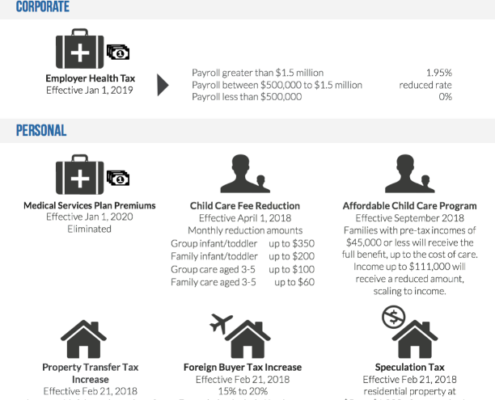

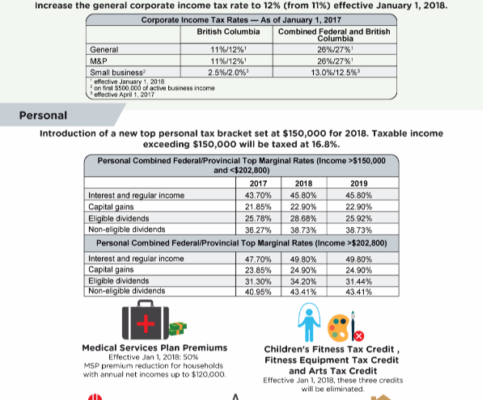

BC Budget Highlights 2018

BC Finance Minister Carole James delivered the province's 2018 budget update on February 20, 2018. The budget anticipates a surplus of $219 million for the current year, $281 million for 2019 and $284 million in 2020.

BC Budget Update

BC Finance Minister Carole James delivered the province's 2017 budget update on Sept. 11, 2017. The budget anticipates a surplus of $46 million for the current year, $228 million in 2018-2019 and $257 million in 2019-2020. As a result of the provincial election on April 11, 2017, the measures previously announced were not fully enacted.

Federal Budget 2017: Business

Finance Minister Bill Morneau delivered the government’s 2017 federal budget on March 22, 2017. The budget expects a deficit of $23 billion for fiscal 2016-2017 and forecasts a deficit of $28.5 billion for 2017-2018. Learn what the budget means for small business owners.