The Corporate Estate Transfer

If you are the owner of a successful company it is likely that you have retained profits or surplus cash in your corporation. If this is the case, chances are also good that this invested surplus is exposed to a high rate of corporate income tax. If this describes your company then you may be a candidate for the Corporate Estate Transfer. This strategy provides tax sheltered growth as well as maximizing the estate value of your company upon your death.

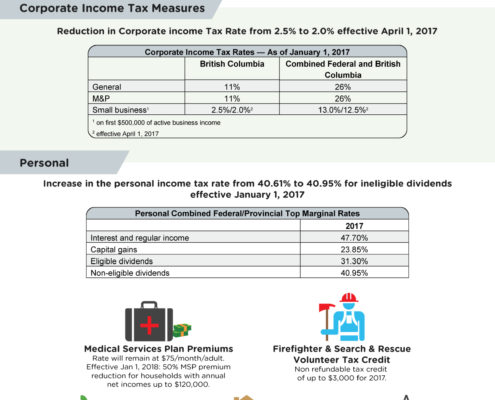

BC Budget 2017

BC Finance Minister, Michael de Jong delivered the province's 2017 budget on Feb. 21, 2017. Learn what the budget means for small business owners and individuals.

Investing with a Safety Net

Investing in today’s environment is not for the faint of heart. However, fortunately for Canadians, Segregated Fund products offered by many life insurance companies provide a safety net for nervous investors.

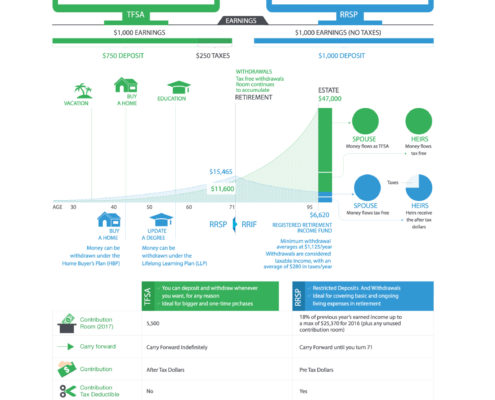

TFSA or RRSP: What’s the difference?

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest.

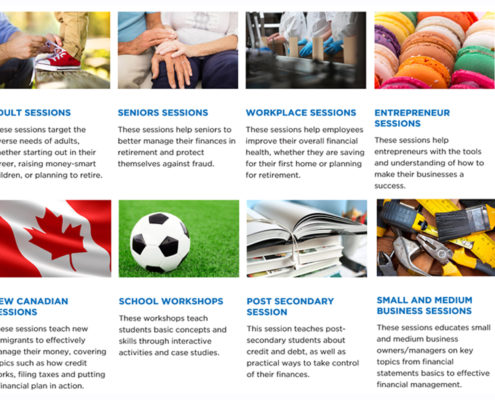

CPA Canada Financial Literacy Free Workshops

The CPA Canada Financial Literacy Program offers free workshops (delivered by approved CPA volunteers) for adults, entrepreneurs, children and new Canadians - with a mission “to deliver unbiased objective financial literacy education & information to improve the overall state of financial literacy in Canada”.

What is Key Person Insurance?

Most business owners understand that assets vital to the success of the enterprise should be insured. Premises are routinely covered for fire and/or theft; vehicles used to make deliveries, insured; machinery needed for manufacturing, also insured. Given that these tangible assets are instrumental in the success of the business, it makes good business sense that the business is protected in the event of a loss. But what about key employees? Many business owners overlook the impact on their business should a key employee die unexpectedly.

The Clock is Ticking so Don’t Miss the Deadline for Higher Tax Savings

2016 is an opportune year to buy life insurance. After this date, certain new policies will not have as much tax-free benefits as they currently do. This means policies approved and issued in 2016 are grandfathered with the higher tax-free benefits, but be aware that most insurance companies need about 3-4 months to get through this underwriting & approval process.

Creative Risk Management Planning for your Business

Many would agree that two of the greatest risks to the sustainability of a business are: not having enough money to keep the company going in times of lower income, and losing the ability to make money. Here are some essential tax-savings & risk management strategies to keep your business going during medical emergencies, save you taxes and leave more money in your pocket.

Should I incorporate?

I'm a sole proprietor- should I incorporate? What's the difference? We outline the differences between a sole proprietorship and corporation.

A Tax Savings Solution Using a Corporate Health Plan

The small business corporate tax rates can be quite a bit lower than an individual's income tax rates, especially as you take more money out of your company. So you can usually save taxes by using of corporate dollars whenever possible. Here's one great idea using your corporation to save on taxes - while also reducing the risk of health issues affecting the sustainability of your company.