TFSA versus RRSP – What you need to know to make the most of them in 2022

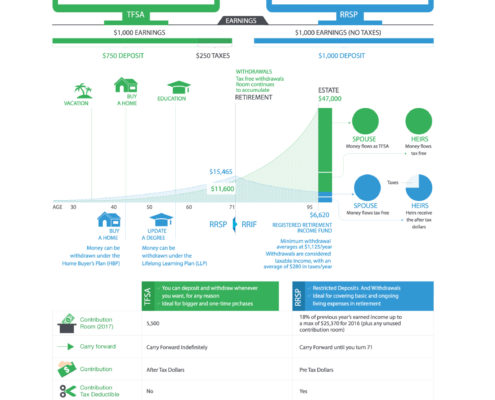

Both TFSAs and RRSPs can be significant savings vehicles for your clients. We've put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year.

• How carry forward works for TFSAs and RRSPs.

• Tax deductibility of contributions.

• Tax treatment of growth.

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

Comparing TFSAs and RRSPs – 2020

We examine the difference between RRSP and TFSA in the deposit and withdrawal stage.

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

2020 Financial Facts for Employees

2020 Financial Facts for Employees includes Consumer Price Index, Bank of Canada Interest Rate, Federal Income Tax Brackets, TFSA, RRSP, CPP, OAS, Probate Fees, Canada Child Benefit, Registered Disability Savings Plan and RESP Numbers.

Investing with a Safety Net

Investing in today’s environment is not for the faint of heart. However, fortunately for Canadians, Segregated Fund products offered by many life insurance companies provide a safety net for nervous investors.

A New Year’s Resolution You Shouldn’t Break

Many of us set New Year’s resolutions for ourselves and often those resolutions have to do with finances. January is the month we say, “Ok, this year I am going to save more and spend less”.

TFSA or RRSP: What’s the difference?

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest.

TFSA or RRSP?

RRSP or TFSA