BC Budget Update

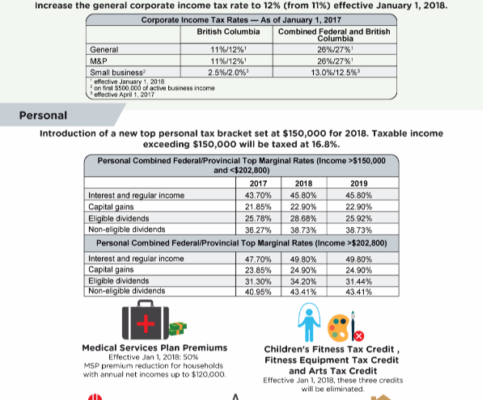

BC Finance Minister Carole James delivered the province's 2017 budget update on Sept. 11, 2017. The budget anticipates a surplus of $46 million for the current year, $228 million in 2018-2019 and $257 million in 2019-2020. As a result of the provincial election on April 11, 2017, the measures previously announced were not fully enacted.

Federal Budget 2017 Families

Finance Minister Bill Morneau delivered the government’s 2017 federal budget on March 22, 2017. The budget expects a deficit of $23 billion for fiscal 2016-2017 and forecasts a deficit of $28.5 billion for 2017-2018. Learn what the budget means for families.

BC Budget 2017

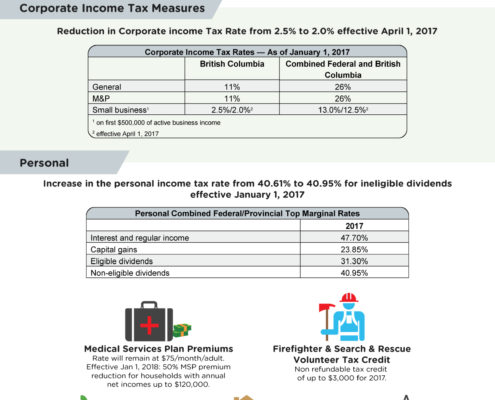

BC Finance Minister, Michael de Jong delivered the province's 2017 budget on Feb. 21, 2017. Learn what the budget means for small business owners and individuals.

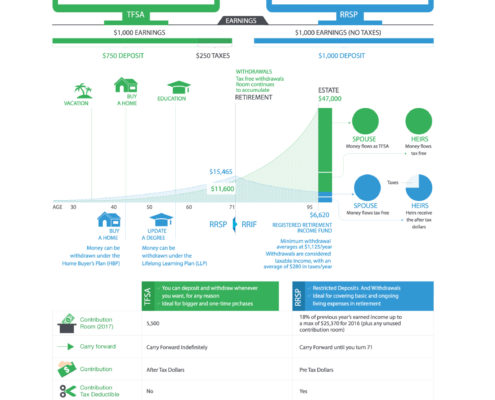

TFSA or RRSP: What’s the difference?

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest.

A Different Perspective on Teaching your Children to be Empowered about Money

Parents who believe that it’s important to teach children “about money” know that this is an important part of helping them be successful in life. Many however find it difficult because they think their children are too young and/or not interested, and they themselves are too busy with life in general. In reality, you are continually teaching them because they learn more from what you do than what you say.

The Benefits of Converting Your Term Insurance to a Permanent Plan

Permanent life insurance can be a very effective estate planning & tax saving tool for your family and business. Converting an existing term insurance to permanent is an easy way to get that permanent coverage - and with the tax rules changing Jan 2017, you get a lot more tax-free benefits if you convert this year.

Estate Planning for Blended Families

In today’s family it is not unusual for spouses to enter the marriage with children from previous relationships. Parents work hard at getting these children to functionally blend together to create a happy family environment. Often overlooked is what happens on the death of one of the parents. In most cases special consideration for estate planning is needed to avoid relationship loss and possibly legal action.

Your Life Could Change in a Minute!

Pay Attention to Your Beneficiary Designation

Naming a beneficiary is a valuable feature of life insurance and segregated funds policies so it is important to carefully choose your beneficiaries.

Beyond Tax-Savings: The Benefits of an Estate Bond for your Estate Beneficiaries

This financial planning strategy replaces your taxable investments with tax-free insurance benefits to your heirs, by-passing your estate and probate fees and keeps this portion of your legacy gifts private.

Understanding your life insurance options

Most people would agree that life insurance is an integral part of any comprehensive financial plan. The question is how to decide on the best type for your needs. This document can help you understand the different types of insurance options and how to select the type of plan that best suits your needs for coverage.